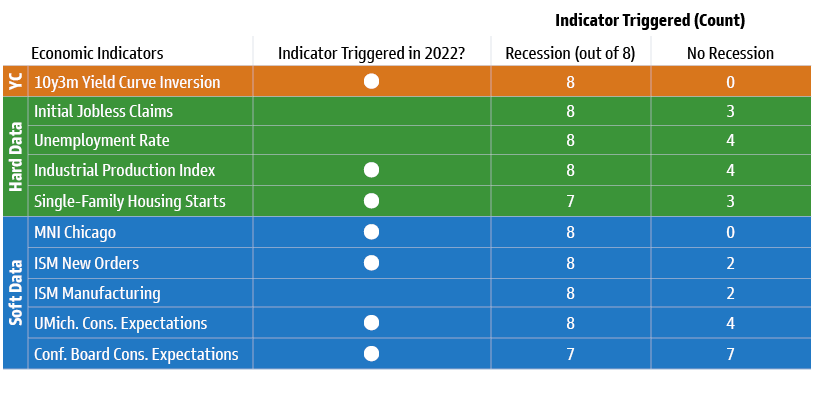

As we near springtime, we find ourselves in a time of transition — is the weather going to be cold or hot? The economy also is in transition, and with lots of contradictions — are we going into a recession or not? Deteriorating economic indicators have had a strong track record of predicting recessions, but many have incorrectly warned of oncoming contractions. Soft and hard data hit recessionary levels in 2022, but the big question is whether the Federal Reserve and other banks will find a way to subdue inflation without causing a recession.

Labor remains strong, and inflation continues to show signs of cooling. Consumers are spending money, as seen in a retail sales increase of 3% month over month in January. Wage growth is slowing but remains fairly high. On the flip side, growth in average hourly earnings has slowed relatively quickly. The Fed has recently indicated concern that inflation in the service sector (not including housing) remains stubbornly high. However, weakening consumer spending suggests price growth will continue to slow. Banks have made it harder and more expensive for consumers and businesses to obtain credit and financing.

With rates rising for mortgages, credit cards and auto loans, the Fed’s tightening policy is on track to slow consumption and demand. As we have written before, this is one of the two methods the Fed is employing to slow down inflation: reducing demand and increasing unemployment to slow wage growth.

Global manufacturing has lagged following the pandemic as inventory shortages turned to gluts. Now, however, signs have started to emerge that manufacturing may be bouncing back as surplus inventories are down. Growth in manufacturing would be a good sign for the global economy. The tradeoff, though, is that such a recovery could prevent central banks from cutting interest rates, as many have predicted later this year.

With all the conflicting messages and information, we must continue to look ahead. We use leading economic indicators to point to future events; lagging indicators tell us where we have been, helping us confirm a pattern. Both serve a purpose, but the markets are forward-looking, often telling us what may happen ahead of time.

As we reallocate and rebalance our client portfolios to account for where we think the market is heading, we are making the following changes:

1. From a fixed-income perspective, last year we maintained a shorter duration in the portfolio as the Fed remains in a tightening cycle. The very short end of the curve has continued to rise, yielding to higher money market and Treasury rates. We feel that most of the interest-rate change is accounted for in the bond market. At the same time, in taxable accounts, we added a tax-free municipal bond position instead of a taxable bond fund, as municipal bonds offer great value in this market. We are watching the Fed closely for indications of the end of the rate-hiking cycle and will look to adjust the duration of the portfolio when there is further clarity.

2. Last year, we did a significant amount of tax-loss harvesting to take advantage of a down market. As we potentially enter a recession or a market bottom, diversification and active management should play a larger role. In 2022, both stocks and bonds fell together. Cash, some commodities and energy stocks were the lone survivors in an otherwise bad year. We continue to believe in both passive and active funds in the portfolios, depending on the asset class. We are swapping out passive investment in small-cap stocks for an active manager. At the same time, we are adding an exposure to emerging markets. In 2023, China is reopening after several years of lockdowns, and the dollar is weakening. The portfolios are not overweight in either stocks or bonds and have a good mix of growth and value. We feel the portfolios are prepared for either an upside surprise or continued volatility.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out. We are not guessing or market timing.

We are anticipating and moving to those areas of strength in the economy — and in the stock market. We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns.

We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been. It is important to focus on the long-term goal, not on one specific data point or indicator.

Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Bloomberg, GSAM, Investopedia, Schwab

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.