The dog days of the summer are upon us. As the weather heats up across the U.S., market volatility is cooler than it was before COVID. Last year’s market volatility hastened a flight to cash for many, with record inflows for money market and short-term Treasury notes.

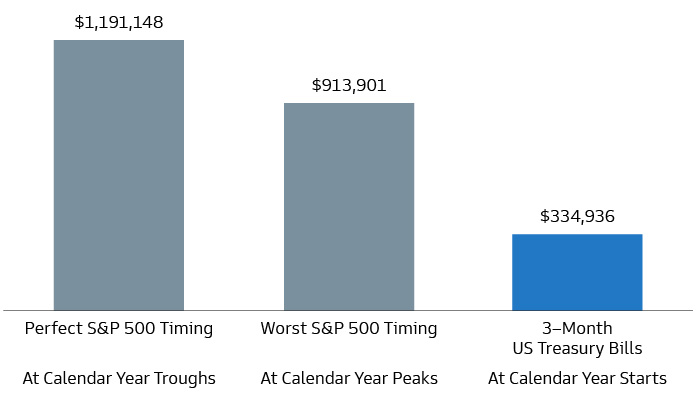

You have heard this from us many times, and we will continue the same mantra: Overweight cash allocations may come with high opportunity costs, i.e., missing out on the market. As the chart below shows, the difference in ending portfolio values between perfectly timed annual S&P 500 contributions and the worst-timed contributions is only $300,000. But the difference between the worst-timed contributions on an annual basis into the S&P 500 and holding cash in short-term Treasury notes is almost $600,000.

Hypothetical Portfolio Value with $12,000 Annual Contributions (2000-2023 YTD)

We are on much better footing than we were at this time last year (and even at the start of this year), from both a growth perspective and an inflation perspective. The S&P 500 is about 8% from its all-time highs.

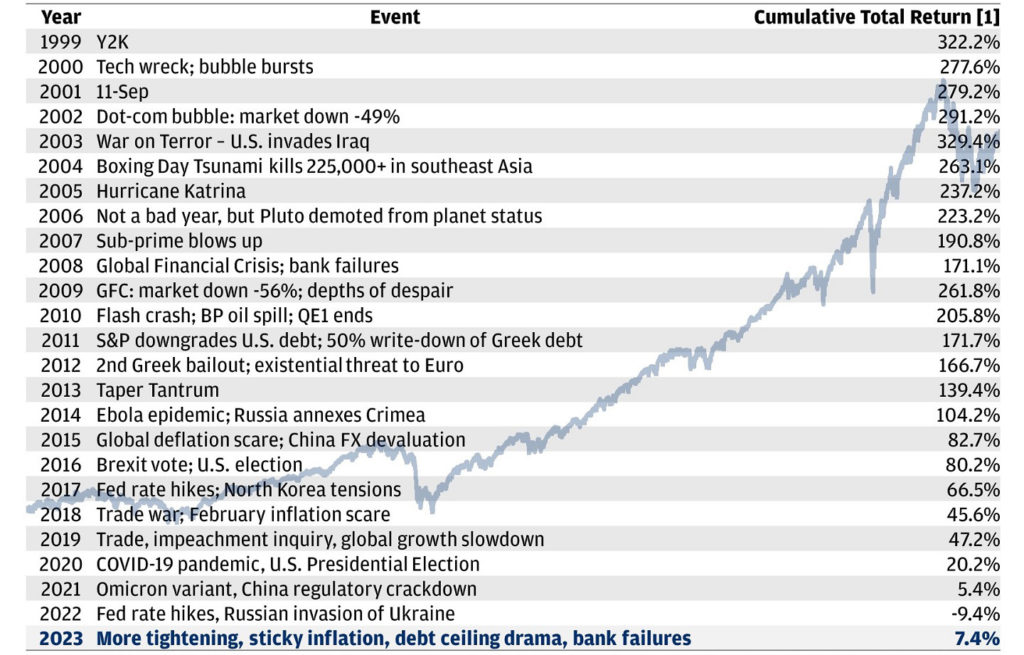

We don’t know when the next shoe will drop, or what will cause it, but there are always opportunities in the market. Stocks remain long-term growth engines of investment portfolios. The chart below looks back over the significant news headlines of the last 23 years; if you were invested in 60% stocks and 40% bonds over that time frame, the cumulative return could have been over 300%.

Only one time period (2022) shows negative growth, and that was because there has not yet been enough time to recapture that loss. Staying invested through all the bad news — and not timing the market — remains the best strategy.

Investment Portfolios Are Built to Last

U.S. 60% equity, 40% fixed income portfolio returns, %

From a portfolio-management perspective, we continue to look ahead. The markets are forward looking, often telling us what may happen ahead of time. We are watching for the most anticipated recession in history. At the same time, the underpinnings of the new bull market seem to be alive and well.

Housing is making a turnaround, and that is positive for the economy. Inflation continues to show signs of weakening. With an eye on the future, we are making the following portfolio changes as we start the third quarter:

• Over the last year and a half, we have maintained a shorter-duration fixed-income portfolio, as the Fed has been actively raising rates. The portfolio benefited as the very short end of the yield curve (one year and less) saw higher interest rates. The longer-dated maturities and end of the yield curve have continued to yield less than the short-end (inverted yield curve). The Fed paused in June from raising interest rates, after 10 consecutive rate hikes.

There is a possibility of another one or two interest rate hikes, but we believe most of the change is already accounted for in the bond market. Since we are near the end of the Fed raising rates, we are extending the duration of the portfolio and removing our short-duration position. With this strategy, we are able to increase the overall yield of the fixed income portfolio to be well positioned for when the Fed decides to reduce interest rates — and to capture capital appreciation as well.

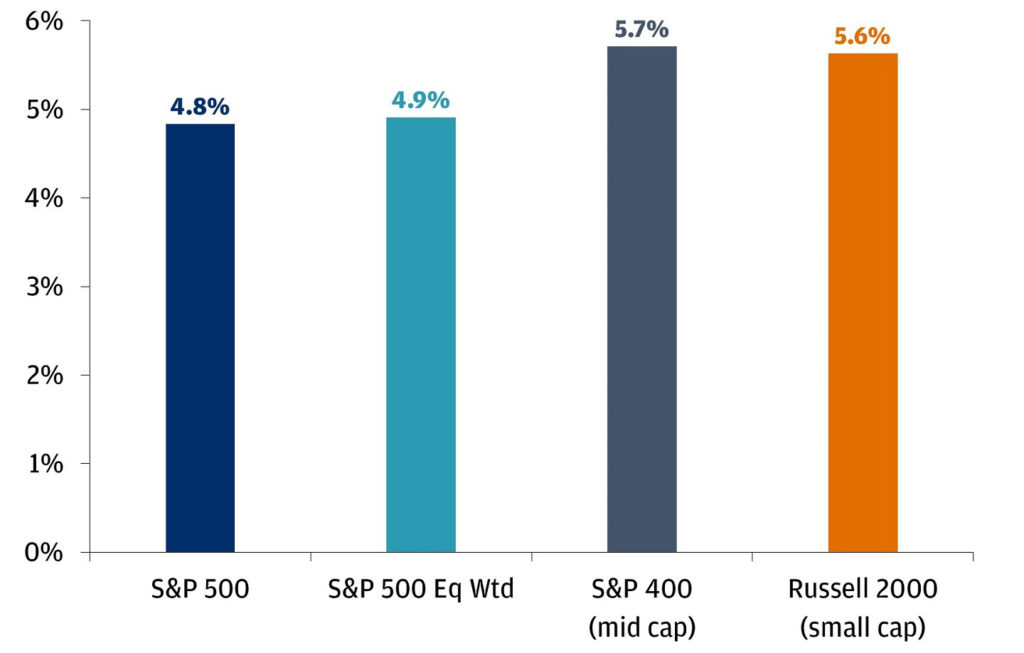

• For the month of June, we started to see more stocks participating in the rally that has been dominated by mega-cap technology names since the start of the year. More than 10% of stocks in the S&P 500 hit a new 52-week high last week, the most since March 2022. As seen in the chart below, other indexes for the month of June are outperforming the S&P 500. With the broadening of the market rally, we are adding an equal weight S&P 500 position to go along with market-weight S&P 500 exposure to provide a more balanced large-cap growth and value mix while reducing exposure to heavily weighted dividend stocks.

In June, the Rally Is Broadening Out Beyond Tech

Month-to-date price return, %

As we enter the second half of the year, the market will be closely watching to see if a recession unfolds, caused by additional interest rate hikes, stubborn inflation and any remaining effects of the banking crisis. The expectation is that the recession would be mild, lasting one or two quarters and bringing a decline in corporate profits.

Although money market yields continue to provide a nice return now, they will not last forever. We do not know how much, if any, of a potential recession is priced into the markets today, but the portfolio changes we are making are looking past 2023 and are focused on an improving economy in the years ahead.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Bloomberg, Goldman Sachs, JP Morgan

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.

Fidelity Investments and Fidelity Institutional® (together “Fidelity”) is an independent company, unaffiliated with Kestra Financial or CD Wealth Management. Fidelity is a service provider to both. There is no form of legal partnership, agency affiliation, or similar relationship between your financial advisor and Fidelity, nor is such a relationship created or implied by the information herein. Fidelity has not been involved with the preparation of the content supplied by CD Wealth Management and does not guarantee, or assume any responsibility for, its content. Fidelity Investments is a registered service mark of FMR LLC. Fidelity Institutional provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.