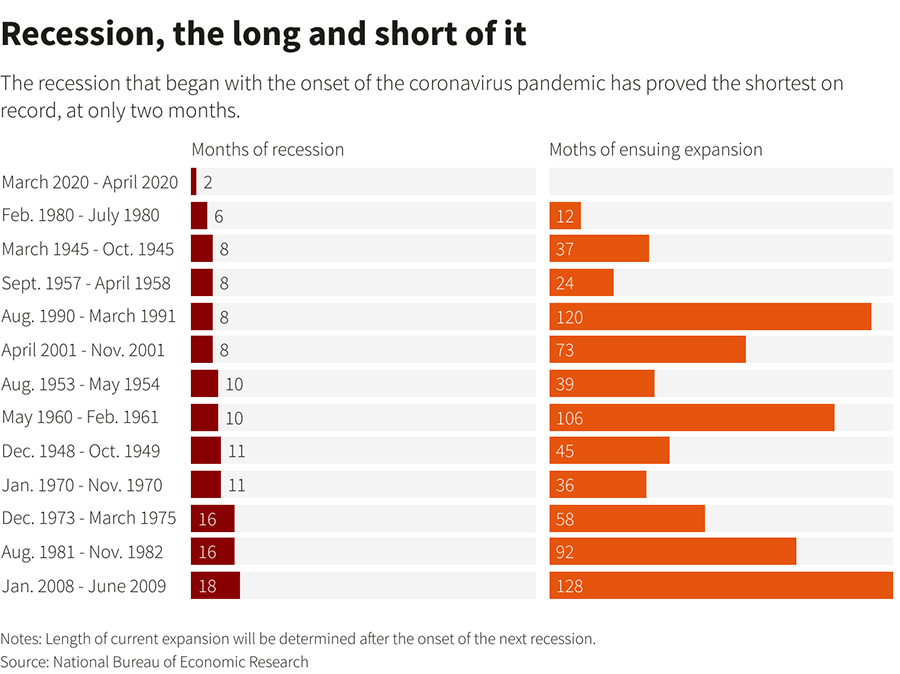

The COVID-19 recession is officially the shortest and one of the deepest recessions on record. February and March of 2020 saw a staggering 31.4% drop in gross domestic product (GDP), followed by a massive snapback of 33.4%. GDP is widely considered the most common indicator used to track the health of an economy. It represents the total dollar value of all goods and services produced by an economy over a specific period. Economists use GDP as one of many factors to determine whether an economy is growing or receding.

The chart below, updated to reflect the most recent recession of 2020, ranks all the U.S. recessions dating back to 1945. The average recession lasts just over 10 months, but on average, the ensuing expansion typically lasts many months longer. We are still in the expansion phase of the economy as we continue to recover from the global pandemic.

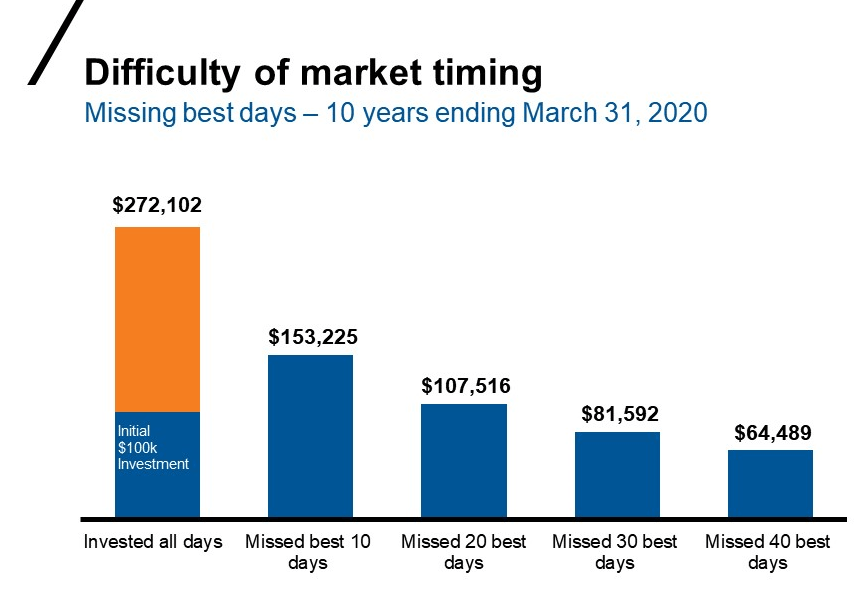

Monday’s market selloff is a reminder of the importance of staying the course and not making drastic moves when the market has a large down day. As we wrote last week, the Delta variant has caused COVID-19 cases to jump dramatically in the U.S., primarily affecting unvaccinated people. Investors sold stocks, worried that the variant would lead to further restrictions in the global economy. As we discuss every week, it is of paramount importance to remain focused on the long term and not to panic or sell into a day like Monday. The chart below shows the importance of staying invested and not trying to time the market. Missing just the 10 best days in the market could severely hurt one’s overall portfolio over the long run.

There may be some instances of additional restrictions being reimplemented, but overall, economic restrictions will continue to be lifted, and we should soon see a return to a new, post-pandemic normal. We already are seeing a resurgence for restaurants, airline travel and other service-oriented parts of the economy.

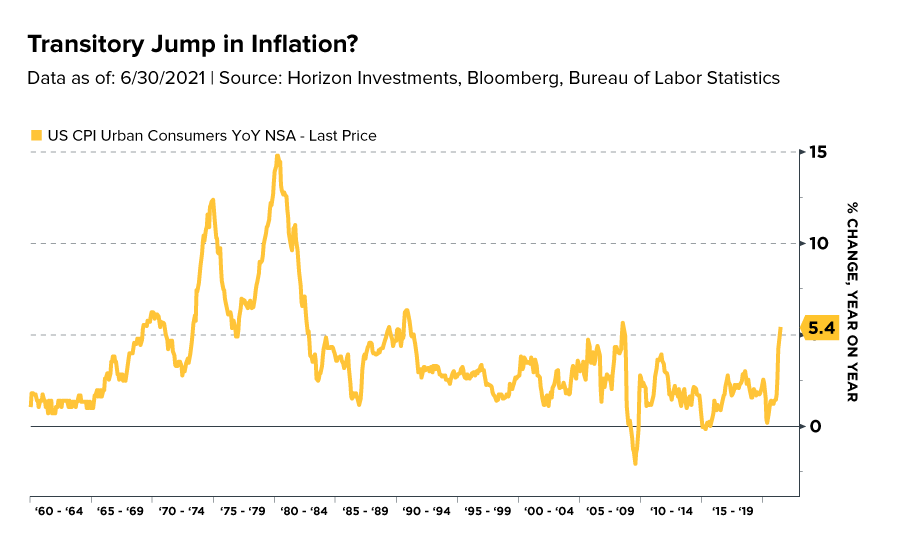

The Federal Reserve continues to watch inflation closely — especially after last week’s CPI report showing that inflation has grown at 5.4% year over year, as shown in the above chart. The response by the Federal Reserve has been that the spike in inflation is temporary and remains a supply-and-demand issue that will abate slowly as the world economy continues to reopen. When prices surge, buyers may pull back their level of purchases, which in turn could cause prices to fall. (This is evident in the recent tumble of lumber prices.) Also, several disinflationary forces are at work, such as increased productivity of the American workforce, globalization of goods and services and an aging population retiring from the workforce. Even with inflation reaching its highest levels since 2008-2009, the Fed remains stalwart in its stance of transitory inflation, and the bond market seems to agree, as we have seen the longer-term Treasury bonds give up much of the gains from earlier in the year.

So, what can we learn from all this? We continue to watch economic reports such as Consumer Price Index (CPI), unemployment and GDP growth closely. We also continue to monitor the COVID variant’s effect on the global economy and Federal Reserve policy, as well as on China and its increased regulations and restrictions. Strong market fundamentals remain intact as the economy continues to reopen. Market volatility has increased over the last week, as we thought may happen nearing the end of summer and heading into the fall.

From a portfolio perspective, we continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been. Making market decisions based on what might happen may be detrimental to long-term performance. The key is to stay invested and stick with the financial plan. Markets go up and down over time and downturns present opportunities to purchase stocks at a lower value.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. Regarding investments, we believe in diversification and in having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: NBER, Seeking Alpha, CNBC, Horizon Investments

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management. Investor Disclosures: https://bit.ly/KF-Disclosures