If you are 72 or older, you should have recently received a letter that outlines the required minimum distribution (RMD) you must take from your retirement accounts. This is happening because when you reach age 72, IRS rules require you to make annual withdrawals from the following types of tax-deferred retirement accounts: 401(k), 403(b), 457(b), Traditional IRAs, SEP IRAs and SIMPLE IRAs.

Why do RMDs exist?

If you have been saving part of your income in any of the tax-advantaged retirement accounts listed above, you have not paid income tax on those dollars. The government lets you delay paying taxes, but RMDs are how the government ensures it will eventually get its tax dollars on that income. For investors, the benefit of tax deferral is that while we know we’ll pay income tax eventually, we can pay less in retirement than we would during our working years.

Still, it is not unusual for people to find themselves in the same tax bracket — or even a higher one — in retirement. Income from investments outside of retirement accounts, combined with Social Security and RMDs, can add up quickly. At the end of the day though, the difference in tax brackets may not be as big as once projected when comparing retirement and non-retirement income.

When do I need to start taking withdrawals?

You must start taking RMDs when you turn 72 — or continue to take RMDs if you reached age 70 ½ before Jan. 1, 2020. Your first required withdrawal doesn’t have to be made until April 1 of the year after you turn 72. After your first withdrawal, the IRS requires you take RMDs by Dec. 31 each year.

The first time you take an RMD, if you were to wait until April 1 of the following year, then you would have to take a second distribution that same year. Doing so could affect Social Security and Medicare benefits and could lead to a higher-than-anticipated tax bracket.

There is one exception: People still working after age 72 usually may delay taking RMDs from their employer-sponsored plan until they retire. (If you are in that situation, please double-check with the IRS and your company.) However, if you own 5% or more of the business sponsoring the retirement plan, RMDs must begin once you turn 72, regardless of your retirement status.

How much am I required to withdraw?

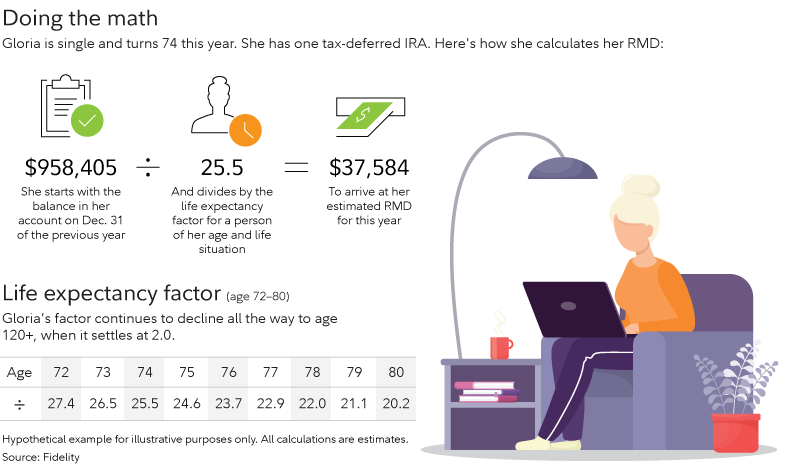

Your required minimum distribution is based on your account value on Dec. 31 of the previous year. The IRS calculates RMDs by taking the sum of your tax-deferred retirement accounts and dividing it by a number based on life expectancy. The chart below illustrates how your RMD is calculated. As you age, the denominator gets smaller each year, so as you grow older, you are required to take out more money the following year. The cost of miscalculating or failing to withdraw the full amount is steep: The IRS charges a 50% penalty on any withdrawals not taken!

How can I minimize the tax impact of RMDs?

If you are 70 ½ or older, you can contribute up to $100,000 per year in a qualified charitable donation (QCD). For married couples, each spouse can make a QCD up to $100,000 — for a potential total of $200,000. QCDs can be made only to certain charitable organizations, and they cannot be made to donor advised funds. If you make a donation that exceeds the RMD, the extra distribution can’t be carried over to meet the distribution the following year.

The RMD is the smallest amount you must withdraw from your retirement account after you reach a certain age. If you have multiple retirement accounts, you may withdraw money from each account or from one account, as long as you ensure that the required minimum amount is withdrawn. Each dollar withdrawn is taxed as ordinary income.

Depending on your tax bracket, it may make sense to take money out of your retirement accounts before age 72. Once you reach age 59 ½, you can take money out of your retirement accounts without a 10% penalty, but you will still owe taxes on the money taken out. It is very important to spend time with your financial team so you understand your options to maximize your income and avoid a costly tax mistake.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Fidelity, Schwab, Securian

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.