U.S. stocks fell hard on Friday, extending a run of three consecutive down weeks in the market. The selling continued to begin the week as investors reacted to disappointing earnings results from Netflix and other companies, the Federal Reserve’s increasingly aggressive talk about interest rate increases, the war in Ukraine and further lockdowns in China. With its drop on Friday, the S&P 500 is down more than 10% on the year and back in correction mode. Market volatility, as measured by the VIX index, has increased as the Fed’s plans to tackle inflation have evolved. We are likely to see continued spikes in the VIX index, given the uncertainty in the current economic environment.

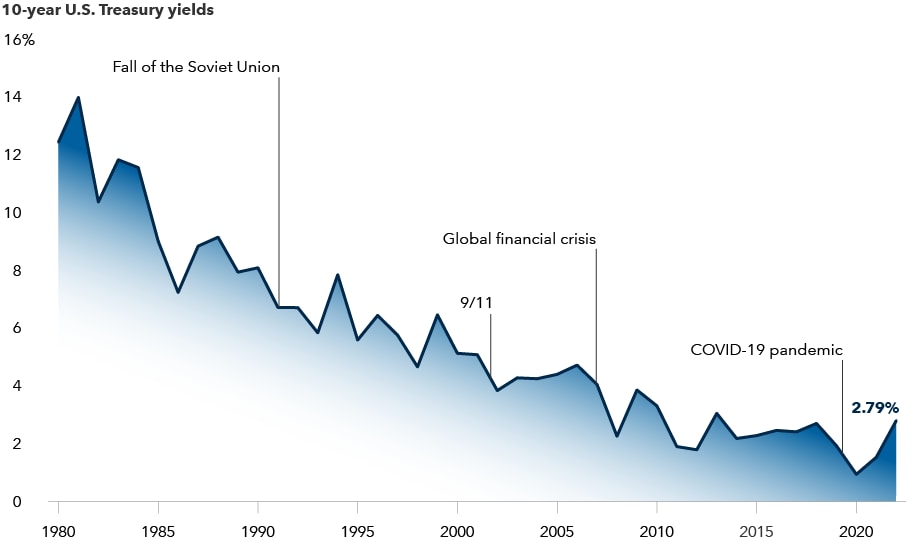

Last week, Fed Chairman Jerome Powell suggested that the central bank may be envisioning a quicker series of interest rate hikes than previously expected. Markets are bracing for a half-point increase in May, with more tightening ahead. The chart below provides a historical perspective of 10-year Treasury yields since 1980; we are a long way from the interest rates many remember from the early ’80s. David Hoag, the portfolio manager of Bond Fund of America said this week, “Central banks will do what they need to do to get inflation under control, but I don’t think that they will be able to go too far before the real economy starts hurting.” What he is implying is that the Fed is not likely to raise the federal funds target rate anywhere near the long-term historical average of 5% (today, we are in a range between .25% and .50%).

Free fall: Interest rates have plummeted in the era of easy money

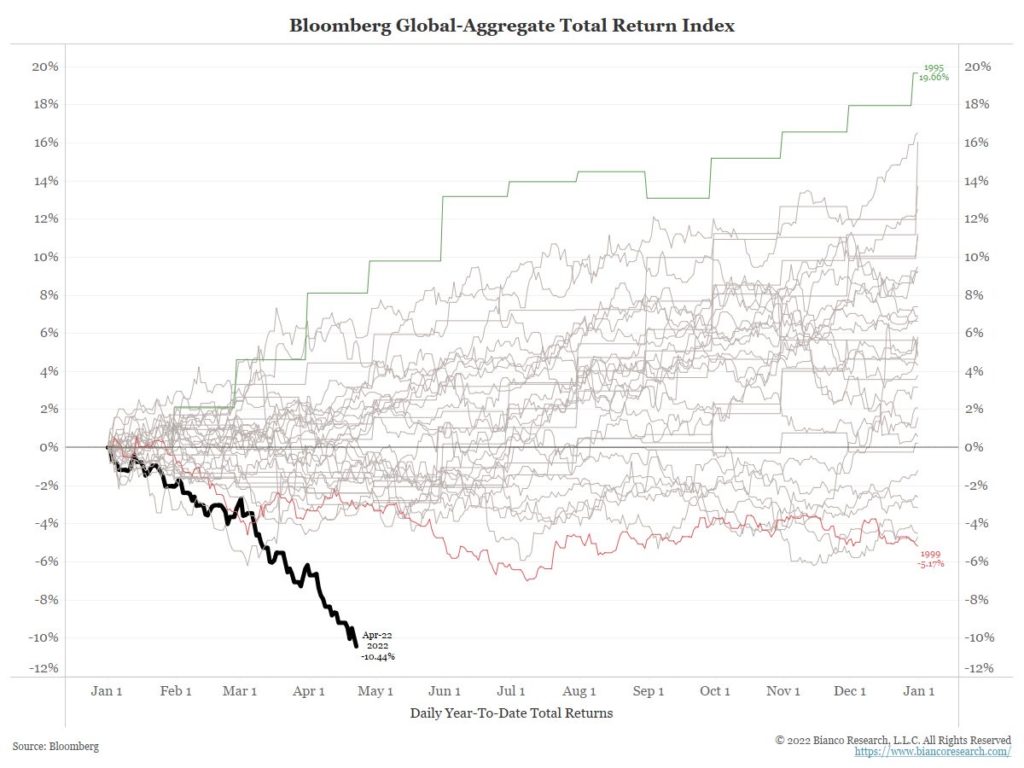

Central Banks around the world are likely to join the U.S. Federal Reserve Bank in trying to get inflation under control. The strong global economy, war in Ukraine and supply chain disruptions continue to put upward pressure on prices. Most investors follow the stock market more than the bond market. As we recently wrote, the bond market has had a rough start to the year. The chart below shows that the bond aggregate index is down more than 10% through Friday. Rate-hike expectations have pushed bond yields higher, with 2-year Treasury yields up almost 2% on the year and 10-year Treasury yields up by almost 1.5%. We believe the bond market is pricing in most of the expected tightening. The good news: Higher yields create potential opportunities for fixed-income investors, who can earn better yields and returns than we have seen in the last three years.

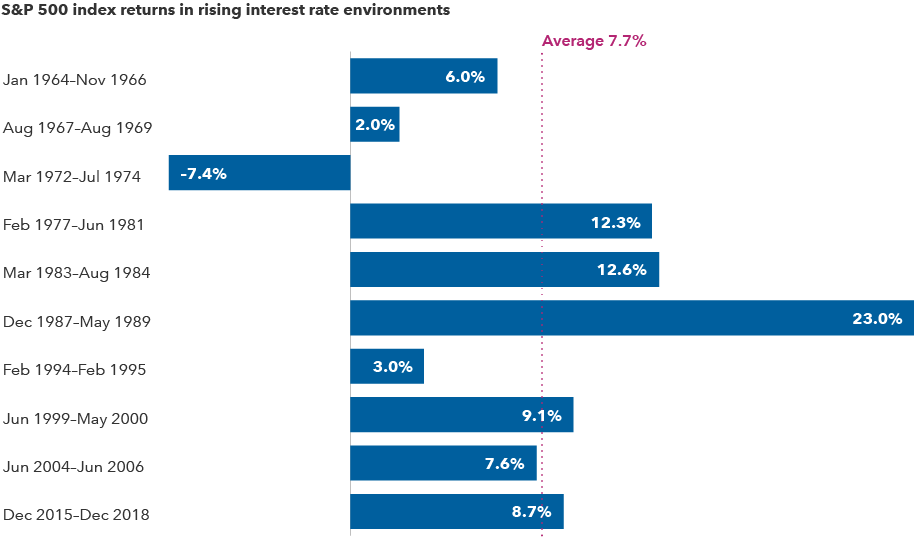

Over long periods of time, markets have tended to adjust to rising rates. During the last 10 periods of rising interest rates, the S&P 500 has posted an average return of 7.7%. Bonds have also held up well during the same time, with an average return of 3.9% during seven rate-hiking cycles dating back to 1983. Of course, the usual caveat remains: Past results are not predictive of future returns, as each market cycle is different.

S&P 500 returns represent annualized total returns

Despite the uncertainties, plenty of reasons for optimism remain, and these are several to watch:

• NATO is unified against Russia, and the Macron victory in France is a big statement for unification.

• Russia is bogging down in Ukraine and struggling to win the war.

• Individual tax revenues are up by almost 35% this year compared to 2021.

• The deficit appears to be shrinking at a fast pace and could end the year at $1 trillion, compared to $2.77 trillion in 2021.

• The Supply Management Purchasing Managers Index, a reliable predictor of growth across the economy, has retreated from its post-COVID peak but remains at levels that signal growth ahead.

• The labor market remains tight and is beginning to draw older Americans who quit or retired during the pandemic back into the workforce.

• Profit margins for S&P 500 companies stood at record levels at the end of 2021.

So, what can we learn from all this? Market volatility can be unsettling, but for long-term investors, it is not unusual. The recent market drop is likely to be a mere blip in the long-term investment plan. We are not going to try to time the market; what really matters is time in the market, not out of the market. That means it is important to stay the course and continue to invest, even when the markets dip. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. In markets and moments like these, it is essential to stick to the financial plan. Remember first and foremost that panic is not an investing strategy. Neither are “get in” or “get out” — those are just gambling on moments in time. Investing is about following a disciplined process over time.

At the end of the day, investors will be well-served to remove emotion from their investment decisions and remember that over a longer time horizons, markets tend to rise. Market corrections are normal, as nothing goes up in a straight line. Making market decisions based on what might happen may be detrimental to long-term performance. The key is to stay invested and stick with the financial plan. Markets go up and down over time, and downturns present opportunities to purchase stocks at a lower value.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. Regarding investments, we believe in diversification and in having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: Bloomberg, Capital Group, Schwab

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.