One of the biggest financial storylines in 2023 was the performance of the market itself: Stocks bounced back from a difficult 2022, and though the ride wasn’t always smooth, those who stayed invested were rewarded for doing so.

Throughout the year, a number of different market themes arose — and as often is the case, some themes repeated themselves often.

ChatGPT and AI

As of January 2023, ChatGPT was the fastest-growing consumer software application in history. It is credited with starting the boom in artificial intelligence, as AI became the biggest market buzzword for the year. It seems inevitable that it will play an increasingly important role in the future economy, and investors appear to recognize the market is still in the early stages of an AI boom.

The Magnificent Seven

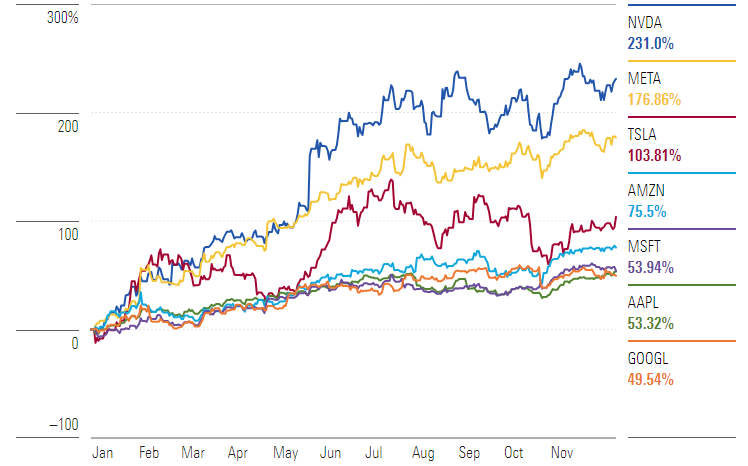

Investors loved the biggest stocks in the market, the mega-cap tech companies: Apple, Amazon, Alphabet (Google), Meta (Facebook), Microsoft, Nvidia and Tesla. All seven stocks have more than doubled the performance of the S&P 500.

Magnificent Seven Stock Performance

Banking crisis

U.S. regional bank stocks plummeted in early March after federal regulators shut down Silicon Valley Bank, the largest bank failure since the 2008 financial crisis.

U.S. credit rating downgrade

Fitch, one of the three main credit rating agencies, downgraded the U.S. long-term credit rating to AA+ from AAA. Moody’s lowered its outlook to negative, as confidence in the U.S. government to navigate shutdowns and increased spending continued to wane.

Inflation

The Federal Reserve continued to raise interest rates in the first half of 2023. Investors finally saw signs that the Fed’s monetary policy tightening was paying off, as inflation started to decrease. CPI decreased from the peak of 9.1% in June of 2022 to 3.1% as of November 2023.

Interest rates

The Fed’s “higher rates for longer” position replaced “Don’t fight the Fed.” The Fed raised interest rates four times during 2023, the last of which was in July. At the last Fed meeting, Chairman Jerome Powell hinted that the Fed may cut interest rates at least three times next year.

Recession — yes or no?

This continues to be a heavily debated topic by Wall Street economists. If we have a recession, can the Fed engineer a “soft landing” or will it continue to be a series of rolling recessions by sector?

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Source: Morningstar

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor regarding your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS.

Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.