Last week in Jackson Hole, Wyo., Fed Chair Jerome Powell gave the all-clear sign that the Federal Reserve is ready to begin cutting interest rates. The Fed has a mandate to foster economic conditions that achieve both stable prices and maximum sustainable employment.

Achieving price stability means inflation is tracking at the target 2% inflation rate, while maximum sustainable employment refers to the unemployment rate — the Fed has set a target of 4.1%. The current unemployment rate is 4.3%, above the Fed’s target.

Powell gave the following key messages at Jackson Hole:

• Inflation is under control and on a path back toward the Fed’s target rate of 2%.

• It’s time for monetary policy to adjust, meaning a long-awaited interest-rate cut at the Fed’s September meeting. The only question will be whether the cut is for 25 or 50 basis points.

• Instead of inflation, labor market conditions are now a top priority for the Federal Reserve.

• If we see further weakening in labor markets, the Fed will look to reduce rates further.

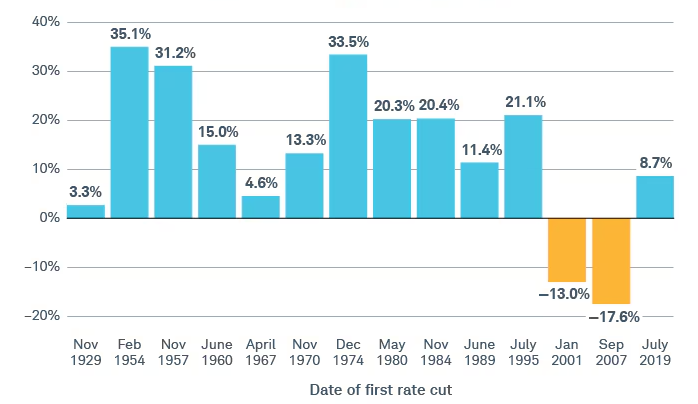

What does this mean for the market — and your pocketbook — now that the Fed has said rate cuts are on the horizon? From a stock market perspective, the Fed has had 14 cycles since 1929 in which it has started to cut interest rates. While not a huge sample statistically, this data still lets us look back and see how markets have performed.

Keeping in mind that past performance does not indicate future results, the S&P 500 has posted positive returns 12 months after the first rate cut 86% of the time. The two instances of negative returns do not resemble the current economic environment: the dot-com implosion and the subprime mortgage crisis. In the 12 times when the market was up, the average return was over 18%.

Why would the market typically go up following interest rate hikes?

Interest rates influence how stock prices and valuations are perceived. Interest rates can affect both price to earnings multiples (P/E) as well as valuations of future earnings. As rates come down, borrowing costs for companies go down, which in turn helps reduce costs and raises profit margins.

All else being equal, if profit margins are higher and costs lower, companies deserve a higher multiple, or P/E ratio, which in turn justifies higher stock prices. From a valuation perspective, a company’s future earnings are based on what is called discounted cash flows: looking at future cash flows and discounting those back to today’s dollars to come up with a price estimate.

If interest rates are lower, the rate to discount the cash flows is lower, in turn producing higher present values of future cash flows, leading to higher stock prices.

S&P 500 Return 12 Months After First Rate Cut

What do lower rates mean for your pocketbook?

Short-term investments like CDs, Treasury bills and money markets that have grown so much in popularity over the last two years will become less attractive. When the Fed cuts rates, it is cutting short-term rates. Money market rates will drop in tandem with the interest rate reductions.

If your money market fund has been earning 5% and the Fed cuts rates by 50 basis points, you should expect your money market to yield 4.5% after the rate cut. Investors will be faced with the question of what to do next as CDs, Treasuries and bonds mature while rates are going down.

Returns After Inflation, 1926-2023

Over the long term, cash has barely kept up with rising prices, while stocks and bonds have delivered average annual returns that have exceeded the rate of inflation. Cash is not a substitute for bonds, even though it helps with portfolio volatility.

Having too much cash creates its own risks, including not earning enough to cover future inflation — but also not providing enough protection against the inevitable downturn in stocks. Historically, when the economy slows and rates come down, attractive short-term rates also come down.

However, that doesn’t mean that longer-term yields will fall in tandem, and it may make sense to extend the duration or maturity of the current bond portfolio to lock in higher yields. While yields on newly issued bonds will come down along with interest rates, the interest or “coupon” that a bond pay remains unchanged until the bond matures or is redeemed by the issuer. That makes it possible for investors in longer-dated bonds to enjoy today’s relatively higher yields, even after rates come down.

Interestingly, bonds have been the only asset class since 1950 to produce double-digit returns during recessions. While the money market, CDs and short-term bonds still look attractive right now, the economy continues to grow, and we are not in a recession.

With the Fed likely to cut rates in September and then again in either November and/or December, investors who stay only in short-term investments may risk missing an opportunity to lock in higher yields. As bonds or CDs come due, it is important to continue to invest those monies into longer-dated maturities, depending on cash needs, to protect against future rate declines.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: CNBC, Fidelity, Morningstar, Schwab

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.

Fidelity Investments and Fidelity Institutional® (together “Fidelity”) is an independent company, unaffiliated with Kestra Financial or CD Wealth Management. Fidelity is a service provider to both. There is no form of legal partnership, agency affiliation, or similar relationship between your financial advisor and Fidelity, nor is such a relationship created or implied by the information herein. Fidelity has not been involved with the preparation of the content supplied by CD Wealth Management and does not guarantee, or assume any responsibility for, its content. Fidelity Investments is a registered service mark of FMR LLC. Fidelity Institutional provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.