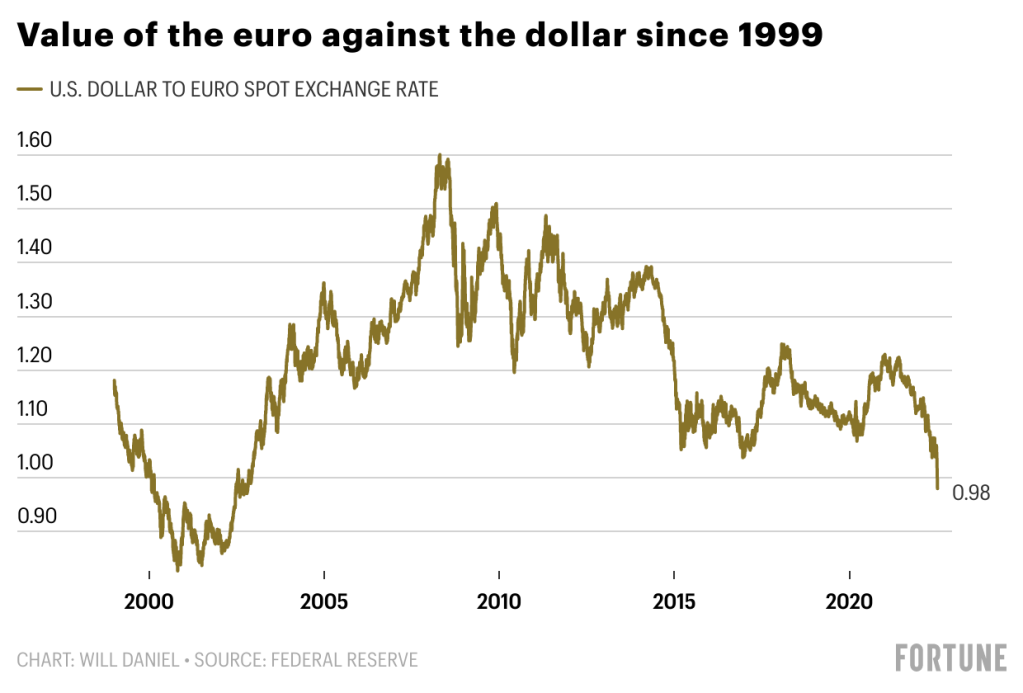

For the first time in nearly two decades, the exchange rate between the euro and the dollar is roughly the same. The parity in the two currencies comes after the euro has plunged almost 20% in value over the last 14 months compared to the dollar. This year, the U.S. dollar has gained against most major currencies, as the Fed’s interest rate hikes have made the dollar a safe haven for investors worldwide who are seeking protection against surging global inflation.

The chart below shows the value of the euro compared to the dollar since 1999 and the wild swings that may occur in the currency markets.

When the Federal Reserve raises rates, as it has done several times this year, Treasury yields also tend to move higher. This attracts more money into the U.S. from international investors, who in turn buy dollar-denominated bonds in hopes of obtaining higher yields than they can obtain in their own countries. The higher the yield, the better the return. The Federal Reserve has raised rates more aggressively in 2022 than many other central banks around the globe.

Another potential dynamic causing the strength of the U.S. dollar is the idea that the U.S. is a safe haven for investments, compared to many other countries. Russia’s war with Ukraine has caused considerable geopolitical and economic uncertainty in Europe. At the same time, China’s zero-COVID policy has been another drag on the global economy. While there is uncertainty in the U.S. regarding a potential recession, the bond market (i.e., U.S. Treasuries) remains a safe investment compared to other countries, boosting the dollar’s attractiveness.

Why does the strength of the U.S. dollar matter? For those traveling overseas, a strong dollar is quite advantageous. A stronger American dollar goes much farther abroad and provides more buying power. Everything is cheaper for Americans traveling out of the country.

From an investment standpoint, the implications may be different. U.S.-based companies that have large international businesses are likely to suffer from a stronger dollar, primarily because converting overseas profits earned in weaker currencies into U.S. dollars can weigh on sales as well as earnings. Income from foreign sales will decrease in value on balance sheets because the foreign currency value has lost value. At the same time, domestically produced goods become more expensive abroad as the dollar increases compared to the currency where the goods are being shipped and then sold, driving down earnings.

On the other hand, goods produced abroad and imported to the United States will be cheaper with a stronger dollar. For example, a luxury car made in Italy will fall in price in dollars with the current parity between the dollar and the euro. If a car costs 70,000 euros and the exchange rate is 1.35, then it costs $94,500. However, if the exchange rate falls to 1.12, it would cost just $78,400.

Many companies will employ hedging techniques that may help improve gross profit margins and recover some of the lost revenue from the strong dollar. Some companies may sell their products overseas, and that may help them recover lost revenue from lower production costs. It also is important to note that currency swings of this magnitude tend to be short-lived.

So, what can we learn from all this? While the U.S. dollar is at parity with the euro for the first time in over 20 years, it is critical to remember that the overarching approach to investing in stocks and bonds is based on long-term fundamentals. There will be quarter-to-quarter fluctuations, currency headwinds and currency tailwinds with every company that performs business in multiple countries. The primary focus is to look at the underlying fundamentals of the businesses and not become consumed with shorter-term currency moves that may affect business for a quarter or two. In the meantime, if you have a trip planned overseas, enjoy the benefits of a stronger dollar.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been. It is important to focus on the long-term goal, not on one specific data point or indicator. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

At the end of the day, investors will be well-served to remove emotion from their investment decisions and remember that over time, markets tend to rise. During volatile markets, it is important to remember that the fear of losing money is stronger than the joy of making money. Investor emotions can have a big impact on retirement outcomes. Market corrections and bear markets are normal; nothing goes up in a straight line.

Making market decisions based on what might happen may be detrimental to long-term performance. The key is to stay invested and stick with the financial plan. Markets go up and down over time, and downturns present opportunities to purchase stocks at a lower value.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. Regarding investments, we believe in diversification and in having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: CNBC, Fortune, Investopedia, MSN

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.