Though the immediate economic impact of Russia invading Ukraine has been in the energy markets, sanctions placed on Russian banking and payment systems are causing increased volatility in global currency markets as well. As the war enters its third week, the Russian stock market was down more than 63% year-to-date before being closed this week, and the ruble hit a record low against the dollar. Global markets are suggesting that Russian debt is at a very high level of default.

You may recall that Russia previously defaulted on its debt in 1998, when it was reeling from the Asian Financial Crisis of 1997 and oil prices trading in the low $20s per barrel. This sent shockwaves through the global markets, culminating with the collapse and liquidation of the hedge fund Long-Term Capital Market. The International Monetary Fund (IMF) stepped in with a rescue package at a time when no government or company was sanctioning the Russian economy. It is difficult to imagine the IMF or other governments (outside of China) stepping in to rescue Russia if it were to default today.

What does the war mean for U.S. investors?

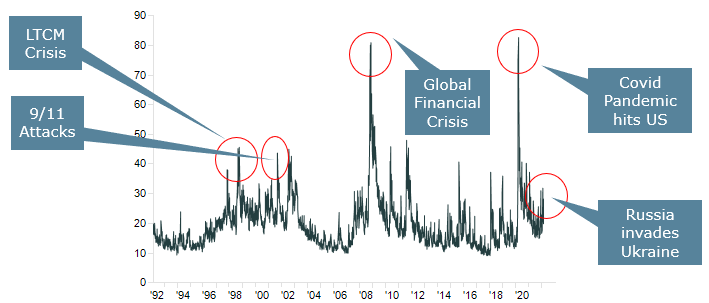

Russia’s invasion of Ukraine adds to the uncertainty that has weighed on stocks since the start of the year. History tells us stocks tend to be more volatile during periods of uncertainty, and while volatility is elevated at the moment, the VIX index remains well below levels seen during the height of the global pandemic or global financial crisis.

____________________

VIX Index, a measure of volatility in the equity market

Russia is the world’s second-largest producer of natural gas and third-largest producer of oil, accounting for 11% of global oil supply in 2021. The risk of a significant cut to the global oil supply has sent oil prices sharply higher. Russia and Ukraine also account for more than a quarter of the world’s wheat exports; we recently have seen higher food and commodity prices as well.

Higher energy and food prices complicate the Federal Reserve’s efforts to handle inflation and rising rates. Higher oil and commodity prices may dampen consumer spending on discretionary items, and therefore, may help to cool economic activity — which takes pressure off the central bank to raise rates quickly.

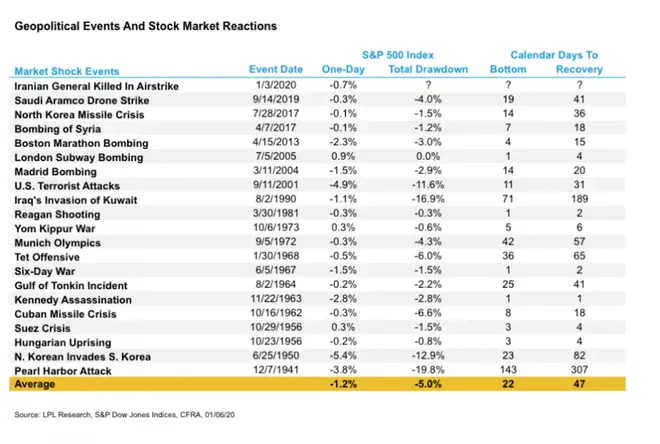

As the chart below shows, stocks have largely shrugged off past geopolitical conflicts. As we often say, the most important factors in stock performance are market fundamentals and the fundamentals of underlying companies.

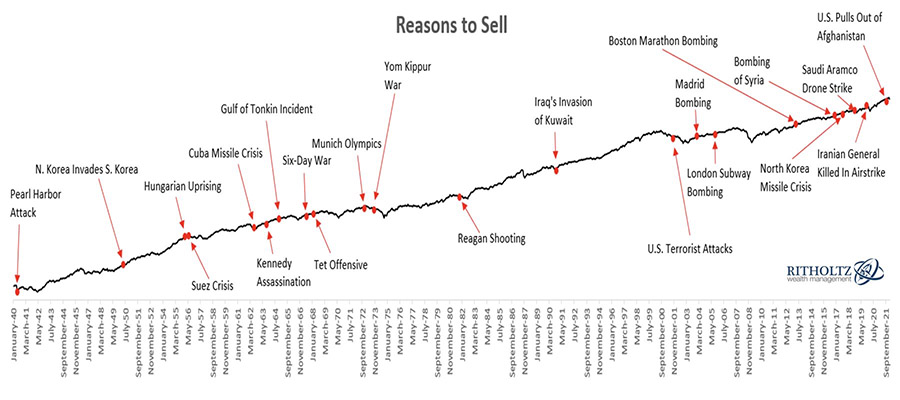

“Over the last few years, markets have been conditioned not to overact to political and geopolitical shocks,” said Mohamed Aly El-Erian, chief economic advisor at Allianz. For a longer-term perspective, notice the chart below that outlines global conflict and crises going back to World War II. If the red dots and lines outlining the geopolitical events were not visible, one analyzing the chart would not make a rational conclusion to sell based on a war. The chart shows a clear trend of positive returns over the long term.

We know that in the context of geopolitical risks, equity markets always have been resilient. The ups and downs triggered by the Russian invasion suggest that we will continue to have increased volatility, but no one knows for sure how long that volatility may last. We expect that the markets will work this out and reach new heights over time. We also expect that along the way, markets will experience sharp declines — much like we are seeing today.

So, what can we learn from all this? Regardless of how the Russia-Ukraine war unfolds, the stock market is driven primarily by U.S. business activity. Although inflation in prices for oil, food and commodities is cause for concern, it remains important to make investment decisions based on logic, not emotions.

From a portfolio perspective, we continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been. As we say each week, it is important to stay the course and focus on the long-term goal, not on one specific data point or indicator.

In markets and moments like these, it is essential to stick to the financial plan.

Panic is not an investing strategy. Neither are “get in” or “get out” — those sentiments are just gambling on moments. Investing is a disciplined process, done over time. At the end of the day, investors will be well served to remove emotion from their investment decisions and to remember that over the long term, markets tend to rise. Market corrections are normal, as nothing goes up in a straight line.

The key is to stay invested and stick with the financial plan. Markets go up and down over time, and downturns present opportunities to purchase stocks at a lower value.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. Regarding investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: FactSet, Forbes, LPL Financial, Kestra Financial, Ritholtz, Schwab

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.