During the first half of the year, the market was obsessed with a potential recession. When would it come? Would it be a hard or soft landing? As the summer moves on, this concern has given way to a quiet calm.

The banking crisis in March and the debt-ceiling debate in May seem like a year ago already, with little damage done to the economy. Market performance for the first half of the year was strong, which was surprising to many. After the rally for the first half of the year, the S&P 500 is less than 10% away from a new all-time high.

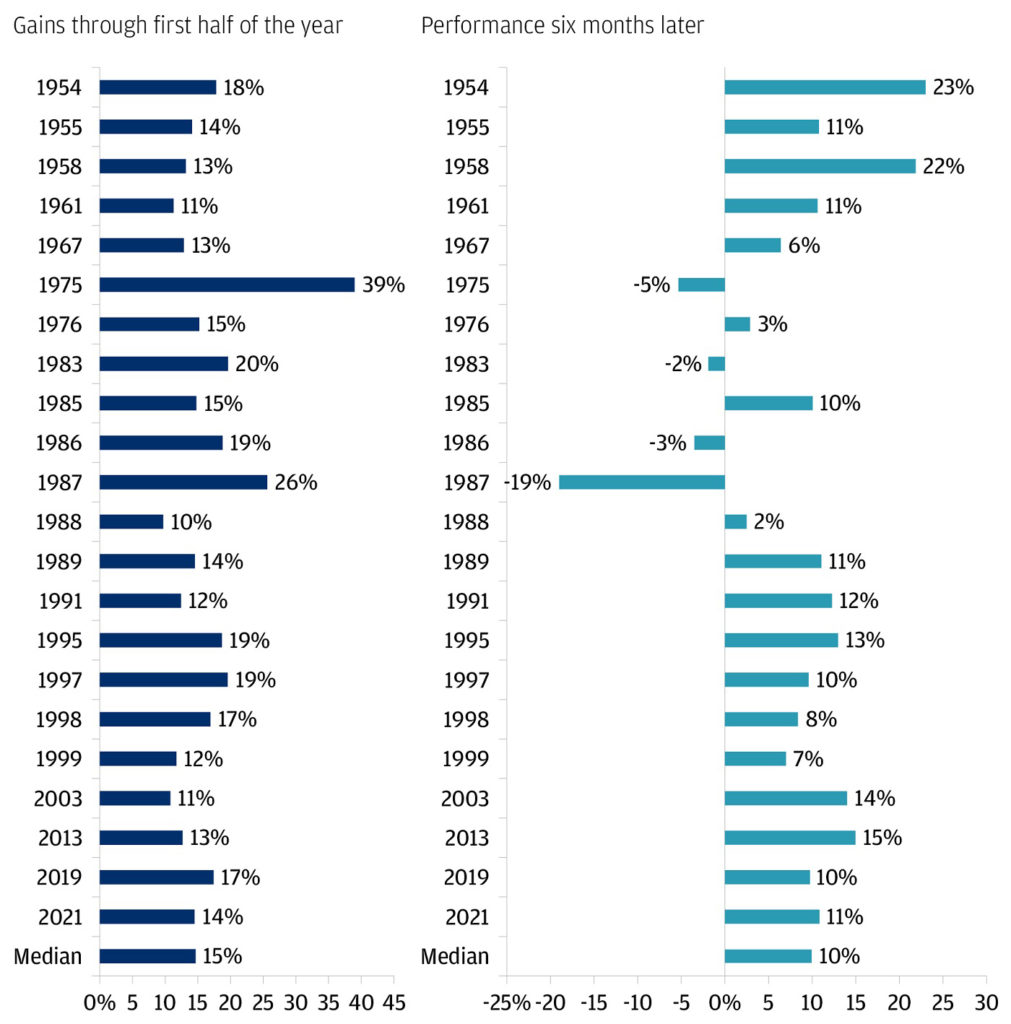

The historical precedent for a potential second-half rally is there: A strong first half of the year typically begets a strong second half, as shown in the chart below. Since 1950, when the S&P 500 has been up over 10% in the first half of the year, the median gain for the index in the second half has been another 10%. Second-half returns after a strong first half have been even better when the prior year was negative. Remember, though, that past performance is not indicative of future returns.

30 Years of S&P 500 Returns After the Benchmark Index Climbed 10% or More Through June

Hindsight makes investing decisions look easy: The average bear market return without a recession was -23%, and the bear market we just went through was down 25.4%. October has been the most common month when bear markets have ended (including seven of the last 18), and last October was no different.

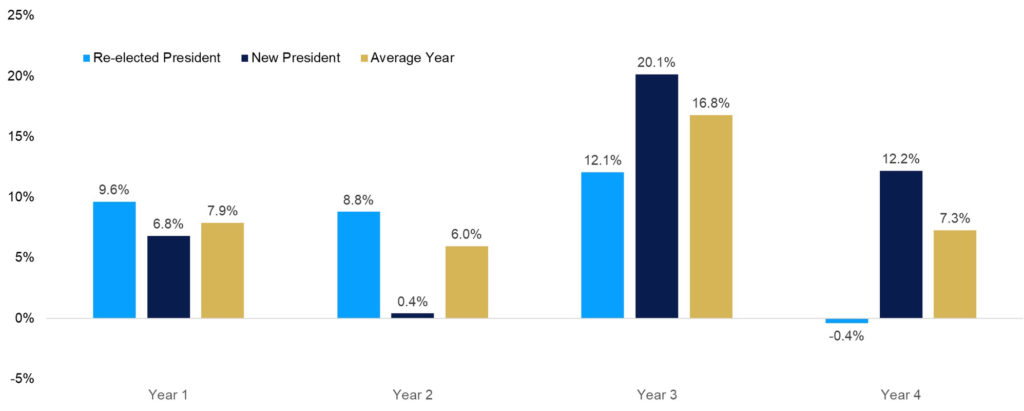

Dating back to World War II, stocks have performed well the year after a midterm election. The chart below outlines year-by-year market performance during the presidential cycle for both re-elected presidents and new presidents. The second year has been the worst for new presidents, and last year was no different. However, the third year for a new president has been the strongest for market returns, and for the first half of the year, this has again held to form.

History shows that elections tend to have little lasting impact on the markets, even if certain sectors and industries are affected by actual policy changes. That does not mean that the volume of politics and commentary won’t rise as we get closer to the end of the year, as next year is an election year.

Under New Presidents, Stocks Underperformed Early and Improved Later

S&P 500 returns based on four-year presidential returns

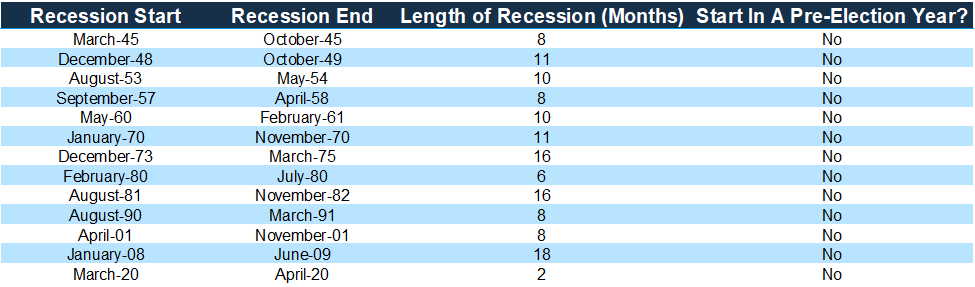

The economy remains resilient as we begin the second half of the year. Going back to World War II, we have not seen the start of a recession in the year before an election year. There is still a chance for a soft-landing or mild recession, but the consumer remains strong. While credit card balances are higher than where they were in 2019, disposable income has grown at a great rate and the percentage of debt to income is lower than before the pandemic.

Unemployment levels remain near all-time lows. Employment growth has now beaten economists’ expectations for 14 straight months. During the first five months of 2023, the economy added 1.5 million jobs.

The housing market is showing signs of recovery as new home sales are up over 30% since November, energy prices have fallen and consumer confidence is improving. Earnings expectations are beginning to rise as margins are stabilizing with inflation coming down. All these factors reduce the risk of a near-term recession.

Recessions Since WWII

The main risk of a recession last year was due to the Fed raising interest rates as quickly as it did. The Fed now is much closer to the end of the rate-hiking cycle. The path back to all-time highs is never easy, but the market has made big strides so far this year. The consumer has driven the recovery and carried the economy.

As a reminder, most Wall Street analysts predicted gloom and doom at the start of the year. On Tuesday, one of the last of the country’s major bear economists issued a mea culpa, admitting to clients that they were wrong and had missed out on the market run since October.

The key to staying on track is to avoid emotional reactions, no matter how stocks perform on a year-in-and-year-out basis.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Bloomberg, Carson, JP Morgan

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.

Fidelity Investments and Fidelity Institutional® (together “Fidelity”) is an independent company, unaffiliated with Kestra Financial or CD Wealth Management. Fidelity is a service provider to both. There is no form of legal partnership, agency affiliation, or similar relationship between your financial advisor and Fidelity, nor is such a relationship created or implied by the information herein. Fidelity has not been involved with the preparation of the content supplied by CD Wealth Management and does not guarantee, or assume any responsibility for, its content. Fidelity Investments is a registered service mark of FMR LLC. Fidelity Institutional provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.