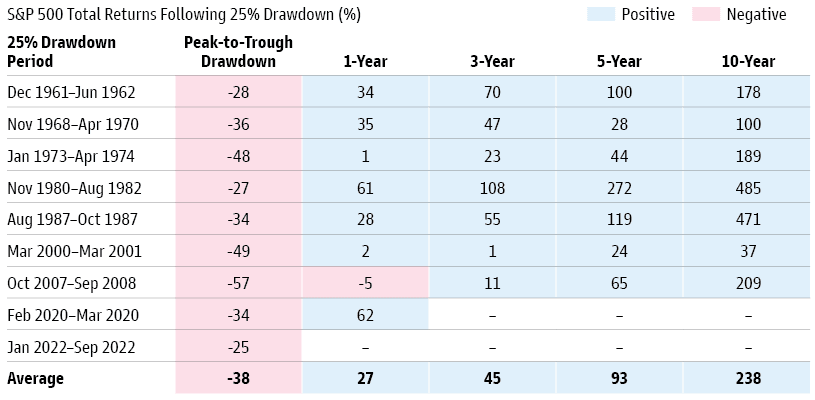

The S&P 500 reached a new low last week, closing 25% down from its January peak. Markets may fall even more from here: Since 1961, the average peak-to-trough decline during drawdowns of 25% or more has been 38%. However, historical drawdowns of 25% or more have delivered a forward one-year return of 27% on average, with longer investment time frames proving even more compelling.

Timing the bottom of this market is difficult, if not impossible, for those considering going to the sideline and waiting to get back in after the market falls further. History suggests that those who stay the course have been rewarded.

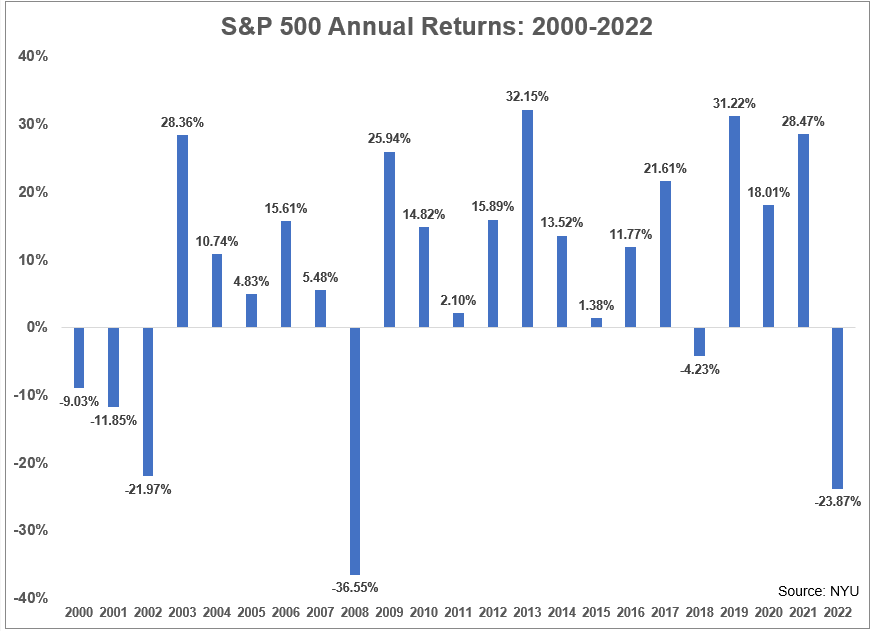

We read a lot about market returns averaging 8% to 10% per year, but as the chart shows below, such returns are not common at all. The 8% to 10% average comes from many years of outsized returns, followed by weak or negative returns and a few years of average returns. If you are not invested in the market or decide to move to the sidelines, it becomes much harder to obtain average returns. We cannot control the sequence of returns – i.e., what the market does on a yearly basis. It’s no secret that investing is not predictable; the market can be up 10% one year and down 10% the next year.

When you are in the accumulation phase, the sequencing of returns does not have a significant impact on your ending balance. However, when you are entering retirement or taking annual distributions from the portfolio, the sequence of returns can make a big difference. A down market early in retirement — on top of taking distributions from the portfolio — can eat into your wealth through no fault of your own, other than bad timing.

While we can’t control bear markets, we can control how we respond to them. The key to overcoming sequence-of-return risk is to draw down as little as possible during that down period. Here are some strategies for the newly or nearly retired to consider:

Revisit your need for distributions:

Take another look at how you are planning to fund your expenses and consider alternate strategies to minimize how much you take out. For example:

• Healthcare expenses: If you funded an HSA account, make sure you use those funds for qualified health expenses before withdrawing from the portfolio.

• Charitable giving: Consider making a large gift to a donor-advised fund during an up year in the market. That fund will become your charitable checkbook so that you do not have to tap into the portfolio during down years in the market.

• Flexible withdrawals: Consider taking out more during up markets and pulling back when the market is struggling. This could help you ride out the down market by withdrawing as little as possible.

Build up cash accounts

One way to limit how much you need from retirement accounts is to build up liquidity in your cash accounts. By maintaining short-term cash and cash equivalents — such as CDs, fixed income, and money market accounts — you can keep from having to draw down your retirement funds prematurely. For the first time in many years, money market rates and short term bond rates offer attractive yields, and you can get paid to be in cash with those monies.

Be wary of debt

It makes sense to enter retirement with as little debt as possible. Excessive debt in retirement can affect not only your financial health, but also your physical and mental health as well, due to the strain of paying off debt without income from work.

Know your retirement account options

Once you reach a certain age (72) or older and have a traditional IRA or 401K, the IRS requires you to take an annual required minimum distribution (RMD). Roth IRAs do not have RMDs, allowing you to withdraw funds without penalty or tax. It may make sense before retirement to convert some or all of a traditional IRA to a Roth IRA. This does require that you pay tax on the conversion amount at the time of the conversion. During a down market, doing a Roth conversion can reduce the taxes that you will pay since the value of the IRA is down, and it allows a future market recovery to happen in a tax-free account.

We fully recognize that bear markets are painful and challenging for all investors. Planning for retirement is a long road trip. On most long road trips, you are bound to run into some trouble — unexpected pit stops, flat tires or even a cracked windshield. But these bumps don’t last for the whole trip, and they do not ruin the overall journey. It is more important than ever to keep perspective and realize that these down markets don’t last forever, and good times have historically lasted much longer than the bad.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Goldman Sachs, Kestra Asset Management, Robert Baird, NYU

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.