Prior to December 2019, if you inherited an IRA from someone who was not your spouse, you were able to take distributions from the inherited account based on your life expectancy and not the original owner’s, a strategy commonly known as a Stretch IRA. The benefit of using a Stretch IRA was that the beneficiary could stretch the taxable distributions over their lifetime, which potentially meant a lower tax bill. The rules were the same for a Roth IRA; even though the original Roth IRA owners did not have required minimum distributions, their heirs were required to withdraw the funds according to their life expectancy.

Under current tax law, the inheritance of an IRA is tax-free, but you are still required to take distributions from the account that may be taxable. When you inherit an IRA, you are free to withdraw as much of the account as you want at any time without penalty.

Stretch IRA rules changed with the passage of the SECURE Act in December 2019, however. The SECURE Act mandates that an IRA inherited from someone who is not your spouse must be depleted by Dec. 31 after the 10th anniversary of the owner’s death. For example: If you inherit an IRA this year, you will have to distribute the balance of the account by Dec. 31, 2032.

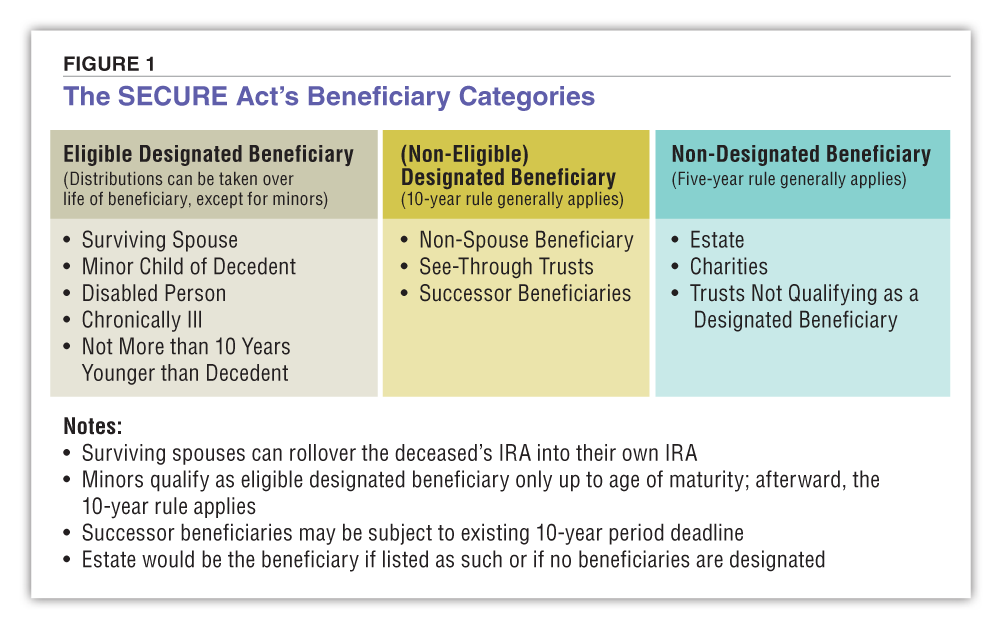

Spousal IRA beneficiaries have different rules and more options to consider when taking their required minimum distributions. As the chart below indicates, there are exceptions to the 10-year rule, such as a surviving spouse, a disabled or chronically ill person, a minor or a person who is not more than 10 years younger than the IRA account owner. These beneficiaries are not obligated to empty the IRA within 10 years but still must take their distributions. If you fall into the eligible designated beneficiary category, the inherited IRA can be taken over the life of the beneficiary (except in the case of minors). If you are a non-eligible designated beneficiary, such as someone who inherits an IRA from a parent, the 10-year rule applies.

What does this mean for me?

If you inherit an IRA and are a non-eligible beneficiary, planning for taxes and how you take distributions becomes more important. Under current law, you have 10 years to deplete the entire value of the IRA. However, if you wait until the 10th year to take the entire distribution and the IRA has experienced significant growth, you may be in the highest tax bracket, having to pay almost 40% in taxes for that one year. If you take distributions over the 10 years, you may incur less tax on an annual basis, and the potential growth of the IRA may be minimized as well. As we have previously written, another way to potentially reduce taxes is to transfer up to $100,000 from an IRA directly to a qualified charity if you are 70 ½ or older.

The IRS has proposed new regulations to the SECURE Act which have yet to be approved. The proposed changes state that if you inherit a traditional IRA from someone who has already passed their required beginning date and had been taking mandatory distributions, you cannot wait until the 10th year to withdraw the money. Instead, under the proposal, you would be required take annual distributions in the first nine years and the balance in the 10th. A tax liability would occur each year from the required distribution.

The SECURE Act has brought Roth conversions into the conversation for those who want to help their heirs avoid a large tax bill. Roth conversions transfer the tax liability to the older generation, because taxes are paid when the conversion is done. If the conversion is done early in retirement, when income is low, the tax bracket may be lower and thus, lower taxes would be paid on the Roth conversion. Then the money can grow tax-free inside the Roth IRA and when the owner passes away, the money can continue to grow tax-free for an additional 10 years.

So, what can we learn from all this? While the SECURE Act effectively eliminated the Stretch IRA, it did not eliminate the need for proper financial planning when it comes to taking distributions from an inherited IRA. We will continue to closely watch proposed legislation about the 10-year rule for inherited IRAs and ensure that our clients take the necessary distributions, if mandated by law. In the interim, we continue to analyze your situation and help you determine what makes the most sense for taxes, investments and your overall financial plan for IRA distributions.

From a portfolio perspective, we continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been. As we say each week, it is important to stay the course and focus on the long-term goal, not on one specific data point or indicator. In markets and moments like these, it is essential to stick to the financial plan.

Remember first and foremost that panic is not an investing strategy. Neither are “get in” or “get out” — those are just gambling on moments in time. Investing is about following a disciplined process over time.

At the end of the day, investors will be well-served to remove emotion from their investment decisions and remember that over a longer time horizon, markets tend to rise. Market corrections are normal, as nothing goes up in a straight line. Making market decisions based on what might happen may be detrimental to long-term performance. The key is to stay invested and stick with the financial plan. Markets go up and down over time, and downturns present opportunities to purchase stocks at a lower value.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. Regarding investments, we believe in diversification and having different asset classes. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: Kiplinger, Investopedia, Forbes, ThinkAdvisor

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.