With just about nine weeks until the presidential election and global pandemic developments making headlines every day, there is no shortage of news for the conscious investor to study. We are always watching out for the developments that will affect our economic outlook, and here are a few that caught our eye this week, including a change in inflation policy, tough times for nonprofits and predictions for the holiday shopping season.

+++

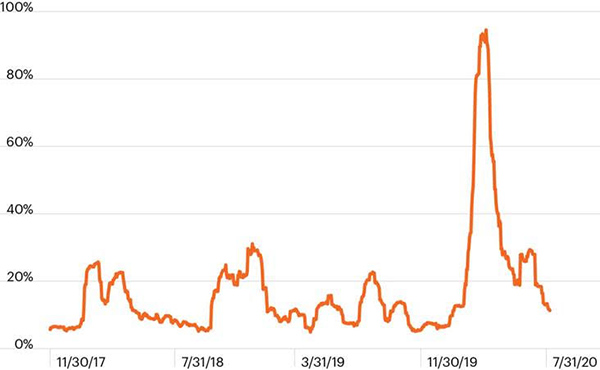

From Forbes: Federal Reserve Chairman Jerome Powell announced last week that the central bank would aim to maintain inflation that averages 2 percent over time. It’s a change from the Fed’s earlier policy, under which it raised rates to keep inflation from going higher than 2 percent.

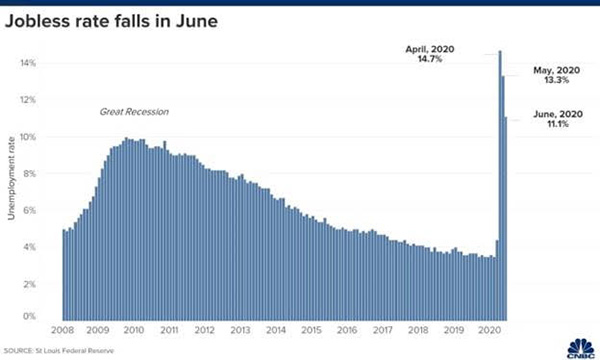

TL;DR: The COVID-19 pandemic cut inflation nearly in half, and by April of this year it had reached its lowest level in a decade. Under the Fed’s new policy, it will tolerate periods of higher inflation in order to balance out periods of lower inflation and to focus on keeping unemployment low.

+++

From CNBC: Few industries have been hit as hard by the pandemic as air travel, but new United CEO Scott Kirby says he believes his business will rebound, especially when it comes to business travel, after a vaccine is approved and distributed.

TL;DR: The Transportation Safety Administration says passenger levels are down 70 percent over last year. United, which has parked 40 percent of its fleet, could cut as many as 36,000 jobs starting in October; the airline is not planning on seeing 2019 passenger levels again until 2024.

+++

From Bloomberg: The head of the U.S. Food and Drug Administration promised that the review of a potential COVID-19 vaccine would be transparent to the public and that data alone would be behind the agency’s decision to approve and distribute it.

TL;DR: A vaccine is considered crucial to end the pandemic and revive the U.S. economy, as well as to President Trump’s re-election campaign. The agency has found itself trapped between accusations of moving too slowly, behind a political agenda, or too quickly, without sufficient data. “I would not participate in any decision that was made on anything other than science,” Commissioner Stephen Hahn said.

+++

From Inc.: Businesses that are hoping to recover from a challenging economy in 2020 by capitalizing on holiday sales would do well to understand consumer trends and opportunities based on the pandemic and its ripple effects.

TL;DR: The economy may pose challenges, but experts say consumers are likely to find a way to spend. Stores would do well to optimize their physical spaces and staffs for in-and-out shopping or curbside pickup and to cater to people who are socially distancing. Home entertainment should be a popular category, and food spending could decline this year. Also, there may be far more returns than normal, based on the rise in online shopping and the decline in shopping in person.

+++

From The Dallas Morning News: Charities across the U.S. say they are being squeezed by competing realities of COVID-19: a drop in donations that is leading to layoffs or furloughs, and economic effects that are causing their services to be more in demand.

TL;DR: Texas is particularly vulnerable to strain on nonprofits, which account for one of every eight jobs in the state. The nonprofit sector is the third-largest workforce of any U.S. industry, with more than 100,000 more workers than the nation’s manufacturers, and though billions in government aid have poured into small businesses, some say nonprofits have been an afterthought.

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management.