It’s safe to say that anyone who spends a lifetime building wealth wants to ensure that it’s managed well for generations to come, to have a plan in place not only for the next generation, but for the ones that follow as well.

For families with adult children – especially those who are transitioning into a new life phase, such as graduating, beginning careers or even starting families of their own – it’s important to plant the seeds of financial planning early.

“We have clients we’ve worked with since the mid-1990s, when the kids were tweens,” said Scott Cohen, CD Wealth Management’s principal, founder and CEO. “As the kids became adults, the parents brought them in and passed on a gift to work with our firm. These former kids now work independently with us and with their own nuclear families.

“It’s really special because now the third generation is growing up, and they know who we are, too.”

If you’re contemplating the best way to help a young adult in your family get started on financial planning, consider these arguments for doing so:

1. Starting early gives you an advantage: The earlier you start planning, Cohen says, the higher the likelihood of success.

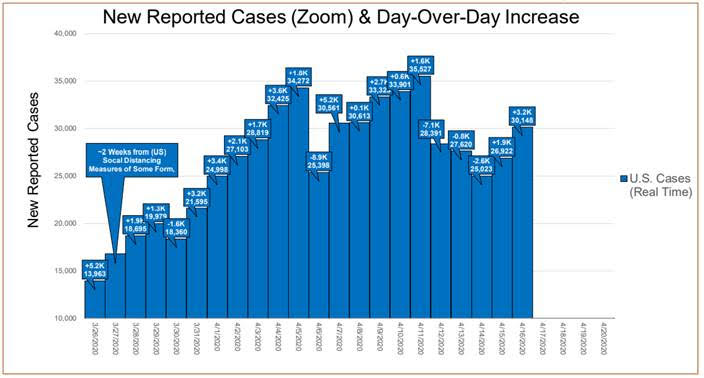

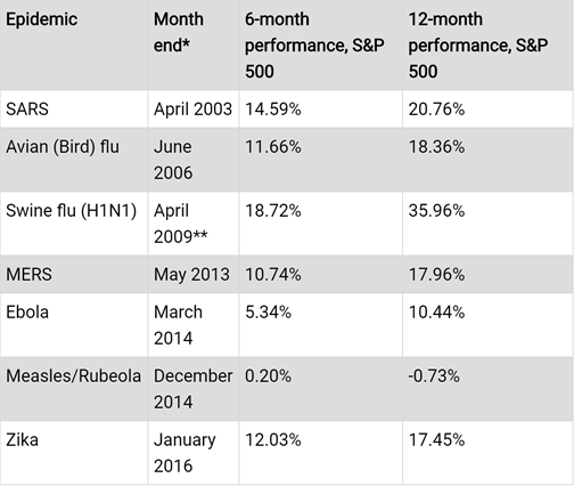

“Take two 22-year-olds – one who maxes out his 401(k) for 40 years and one who waits,” he said. “The one who waits never catches up. Getting an early start gives you an advantage no matter what kinds of recessions come and go.”

2. Sharing a plan makes transitions easier: When an entire family uses the same financial planner, it’s easier to move through the seasons of life together.

“As the older generation starts to age, you want an easier transition where everyone knows what the plan is for all of the assets,” Cohen said. “Kids have to grow up fast sometimes, and picking up the pieces without knowing what to do ahead of time is not a pretty picture.”

3. It’s good to have everything in one place: Think of your financial planner as a hub for all records, account access and measurements against goals – and during times of transition, there will be less upheaval.

“When we work with multiple generations of a family, we manage the transparency so people know what they need to know when it’s appropriate,” Cohen said. “There is usually no need for the youngest generation to have the whole picture, for example, until they’re more mature.

“The key is to have a plan, and it’s our job to carry that plan out.”

4. You will need a neutral party to help you: The best financial planners are experts at dealing with human emptions and the psychology of money, and their focus is on making the right choices from an objective point of view.

“We didn’t earn your money, so we don’t feel the same way you do about it,” Cohen said. “We can act in a way that is not clouded by emotion. Sometimes, people have a hard time making investment decisions on their own.

“We always tailor our approach to each person with logic, objectivity and reason.”

_________

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management.