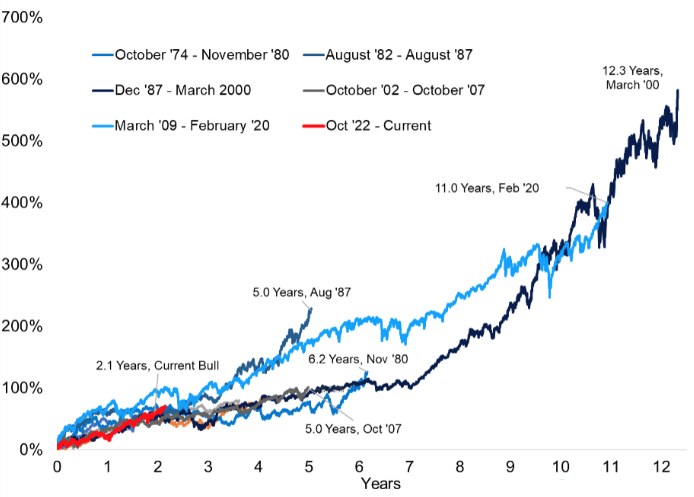

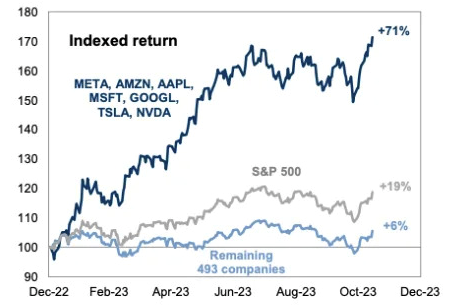

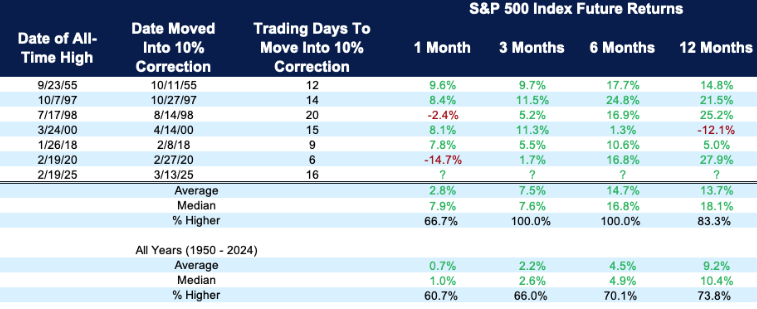

The S&P 500 finished in the positive last week for the first time in more than a month. It wasn’t that long ago that the S&P was down more than 10% on the year and stocks were in correction mode. It took only 16 days for stocks to fall more than 10%, and since that time, stocks have rebounded just as quickly.

Fast bouncebacks are common after fast corrections. As the chart shows, the market has been positive three, six and 12 months after other fast drawdowns in stocks, with an average return of more than 13%. This doesn’t mean that our recent volatility is done or that we won’t revisit the March lows — but it does reiterate our constant drumbeat to ignore the noise and not to time the market because historically, the market has always rebounded.

One of the Fastest Corrections Ever; Now What?

S&P 500 returns after quickest moves into a correction (from all-time high to 10% off peak)

The April 15 tax deadline is approaching fast. Staying informed about policy changes and regularly assessing your financial situation can help you build strategies that align with your goals.

To help you with tax preparation — whether you are doing it yourself or having a CPA help you — here’s a list of the most common documents you will need to gather:

• W-2s: If you work for an employer, you will receive this form, which shows how much you earned and how much was deducted for taxes and other withholdings.

• 1099-NEC (MISC): If you are a contract employee, you can expect to receive this form.

• 1099-INT and 1099-DIV: If you earned interest from savings or investments, you may receive this form. The 1099-DIV reports dividends and distributions from investments.

• Consolidated 1099: This brokerage tax form will show income from dividends, both qualified and non-qualified, as well as any capital gains and losses that occurred during the year.

• 1099-R: If you take a distribution from your retirement account, you will receive this form, which shows the amount of distribution and the amount of taxes withheld.

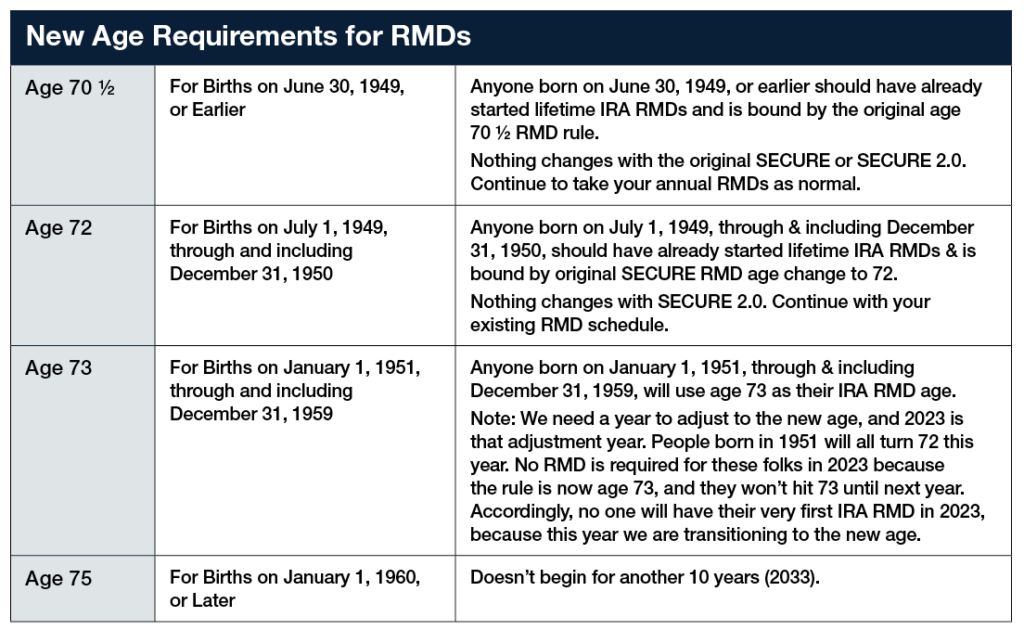

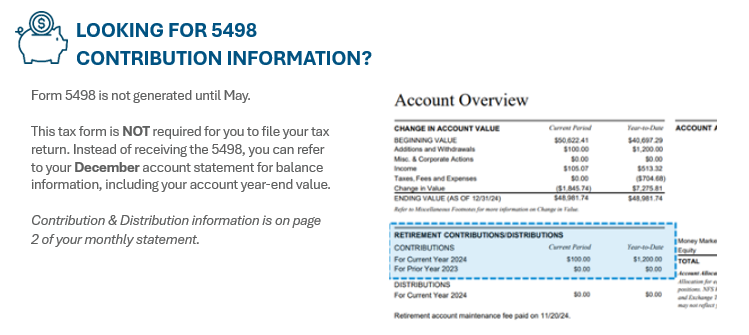

• Form 5498: This form reports your total annual contributions to an IRA account and identifies the type of retirement account you have. Here is some new information about this form for 2024 tax reporting:

— In an effort to be more environmentally conscious and efficient, NFS is sending the Form 5498 tax document only if you’ve made contributions, completed rollovers, reached age 72, or have certain types of investments within your brokerage IRA.

— From now on, the Form 5498 will also be generated in May. This document is not technically needed for filing and provides a clean summary of your IRA activity, which can be useful for future planning or if you ever need to verify past transactions.

— In lieu of this form, you will still need to know how to obtain your contribution and distribution information for your taxes.

• 1098: Those who own a home and pay mortgage interest will receive this form from their lender. It shows the amount of deductible interest a homeowner paid.

• 1098-T: If you have a dependent in college, you will receive this form that reports how much qualified tuition and expense was paid during the year.

• K-1s: If you have any limited partner investments, you will receive this form, which shows each partner’s share of the earnings, losses, deductions and credits.

No one wants to pay more than taxes than they must. The tax code has been simplified over the years, yet it remains incredibly complex.

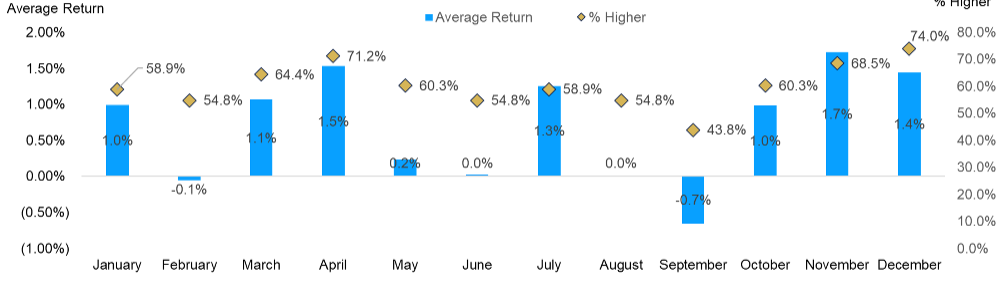

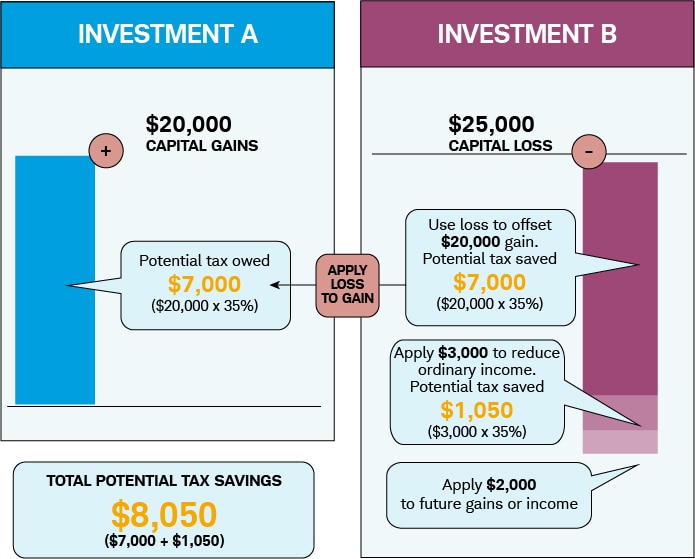

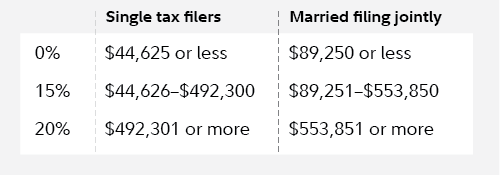

The number of tax brackets has been reduced significantly, and knowing what marginal tax bracket you are in is very important. If you know your estimated tax rate, that may help determine the most tax-efficient investments.

For example, if you are in a high tax bracket, owning municipal bonds may make sense to reduce your taxable income. If you are in a low tax bracket, you may be able to take advantage of lower capital gains rates and pay less on investments sold for a gain. As always, we recommend speaking with your CPA/Accountant to review.

By first understanding the tax bracket, we can plan better tax strategies for you and your family.

If you’re in a higher tax bracket, the following strategies may make sense:

• If you’re older than 70, consider reducing taxable income by using IRA monies to make charitable distributions.

• Consider delaying taking Social Security income until you turn 70.

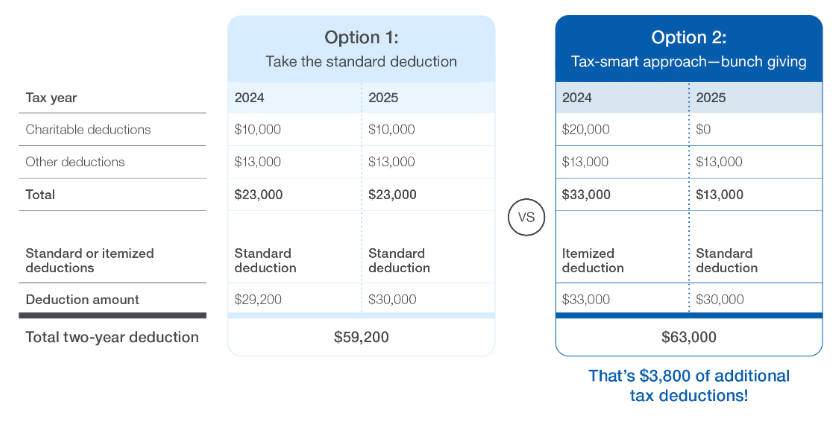

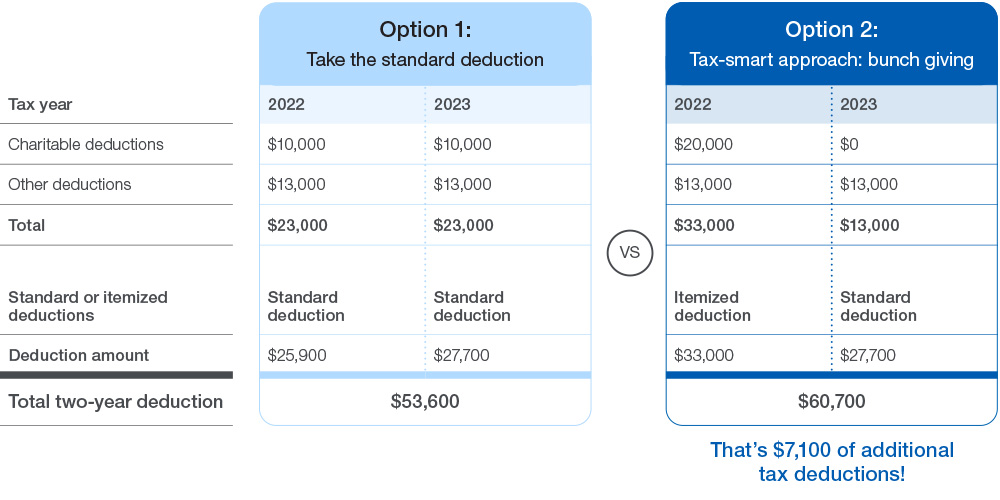

• Take advantage of itemizing by lumping charitable contributions together in one year.

If you’re in a lower tax bracket, the following strategies may make sense:

• Consider increasing withdrawals from IRAs up to the level of the current tax bracket.

• You may wish to convert an IRA to a Roth IRA in a year of lower income taxes.

• If possible, defer income and sale of capital gain property to postpone taxable income.

• If you’re itemizing on your tax return, bunch your medical expenses in the current year to meet the percentage of your adjusted gross income to claim those deductions.

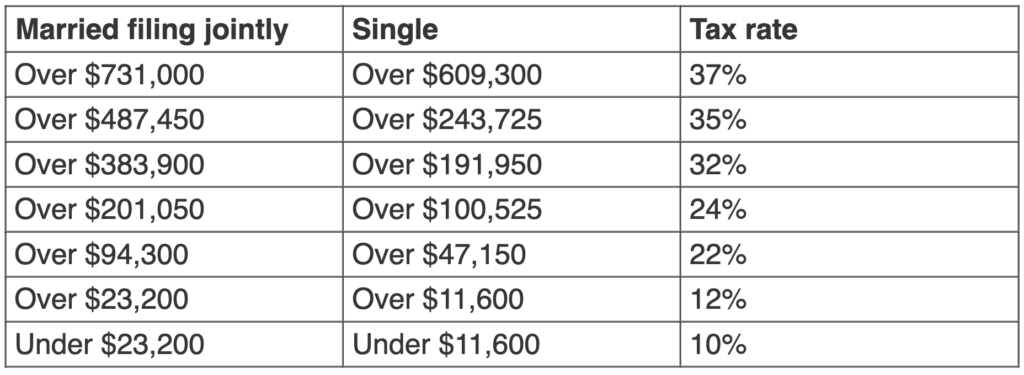

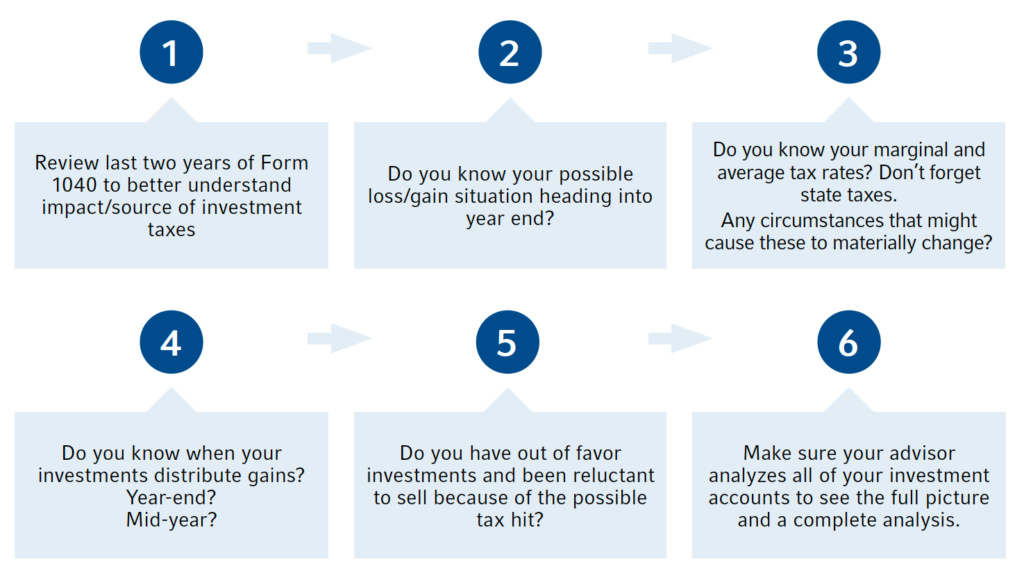

Tax planning is not just a once-a-year event. The chart below is a good reminder that as part of the financial planning process, we are constantly evaluating current circumstances to guide our clients with potential tax saving strategies.

Along with your CPA, we want to ensure we are evaluating the current landscape for tax changes and strategies that may help save future dollars and keep money in your pocket.

Here are some steps to consider before the end of the year:

So, what can we learn from all this? As you prepare to file your taxes before April 15, it is a perfect time to review your financial planning needs. This includes reviewing the investment portfolio, assessing ongoing tax planning opportunities, reviewing retirement goals, and managing your wealth transfer and legacy plans.

The checklist above contains just some of the items that may apply to your family. We are happy to meet to discuss any of the above to make sure you remain on track with your financial profile.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Bloomberg, Carson, CNBC, Fidelity