Benjamin Franklin famously once said that “Money makes money. And the money that money makes, makes more money.” He was referring to compound interest. When interest you earn on a balance in a savings or investment account is reinvested, you earn even more money. You aren’t just earning interest on your principal balance; you are earning interest on your interest as well.

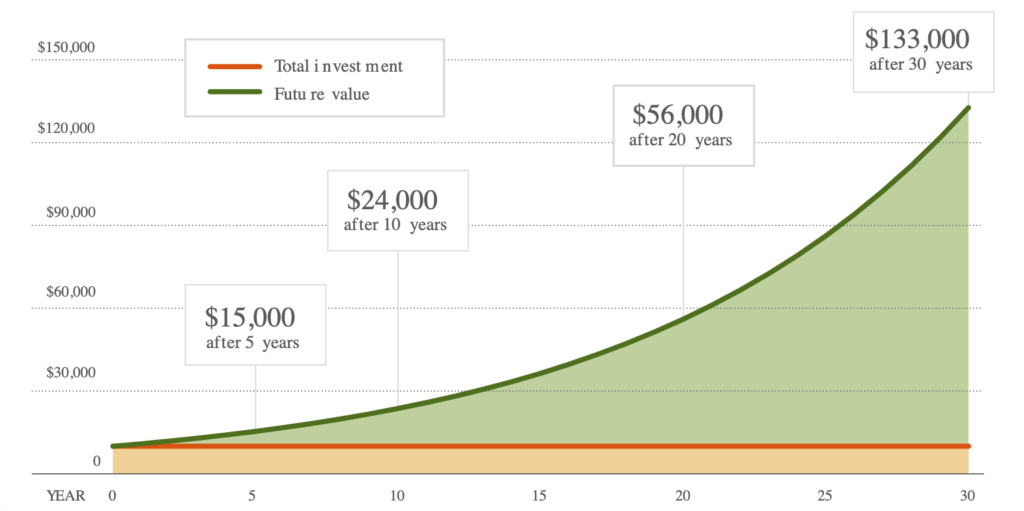

For example, if you make a one-time investment of $10,000, then earn 9% per year, the chart below shows the power of compounding your money. After 10 years. the initial $10,000 investment would be worth more than $24,000 — and after 30 years, it would be worth more than $133,000.

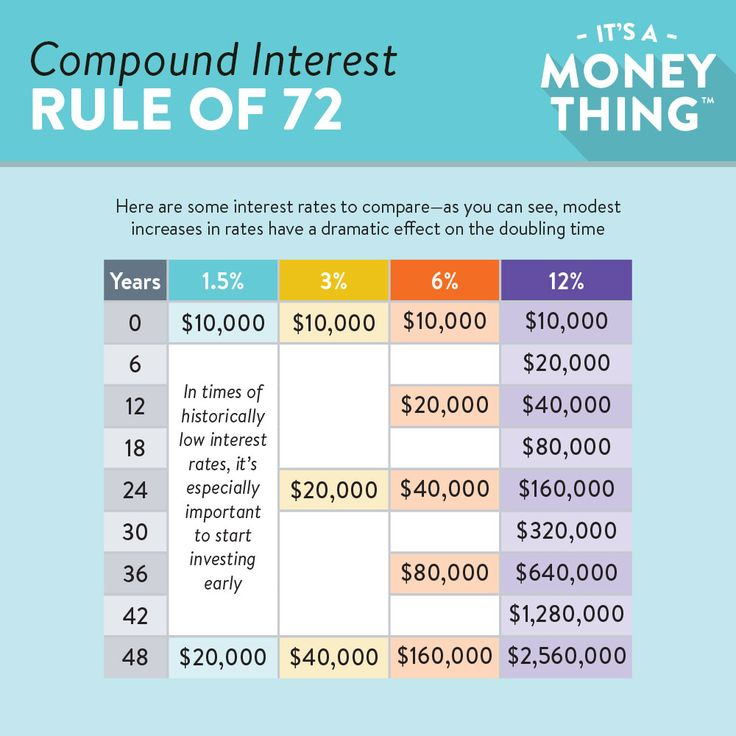

There is a shortcut to help you estimate the value of a future investment, called the Rule of 72. It’s a quick way to estimate approximately the number of years it will take to double your money using compound interest. As seen in the chart below, if you earn a 6% compounded return per year on your investment, then in about 12 years your money would be worth double. If you annualize 12% a year for 48 years, $10,000 could turn into over $2,500,000! To use the Rule of 72, simply divide 72 by the expected annual rate of return and that will provide you the number of years it would take to double your investment.

Simple interest is interest that is earned based solely on the principal amount and is not reinvested. For example, if you have $1,000 and earn a 5% annual interest rate, you will get $50 a year in simple interest. In the second year, you would earn another $50. To calculate how long it would take to double your money with simple interest, the formula would be 1 divided by the rate of return. For example, if you made the same investment of $1,000 earning 5% simple interest, it would take you 20 years to double your money. Note that if you were able to reinvest the money and have it compounding, then it would take approximately 14.4 years to double.

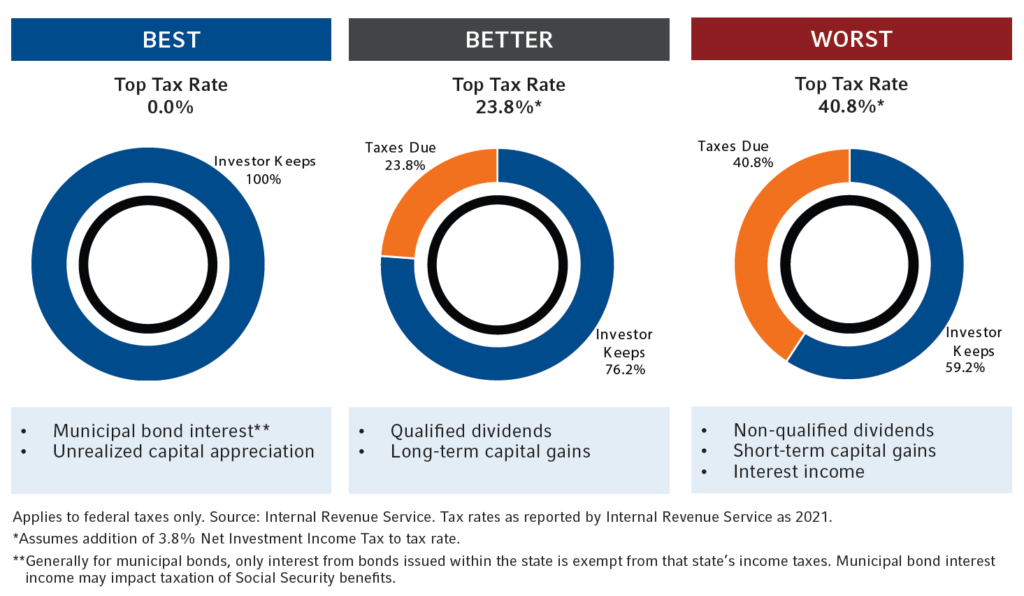

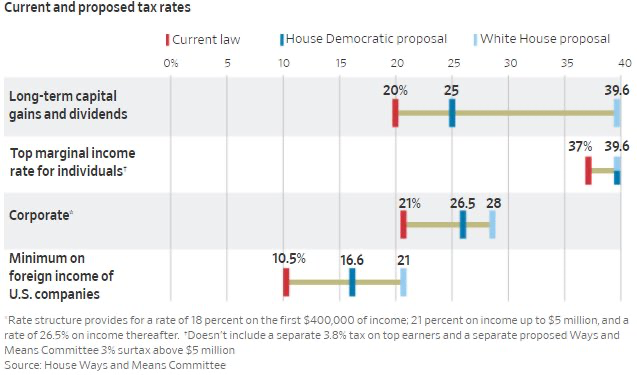

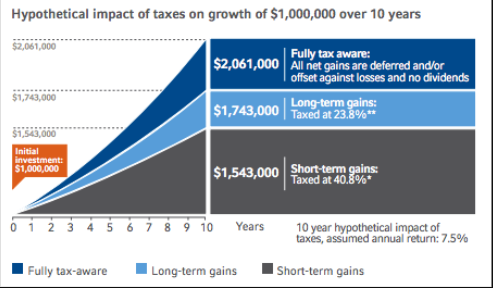

It is important to consider tax implications prior to making any investment. If an investment is going to pay 10% interest on your principal and is in a taxable account, your actual return may be only 6% if you are in a top tax bracket and the income is taxed as ordinary income. If you are not able to reinvest the income, then the income becomes simple interest, and your money can take even longer to double. Suddenly, the 10% investment return that sounded great may not be nearly as good.

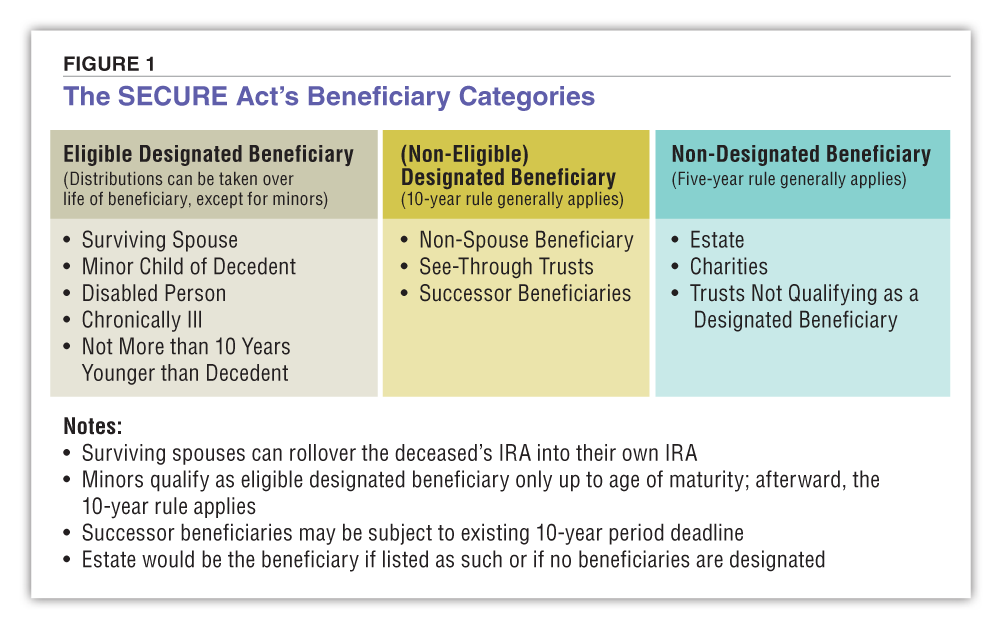

Taxes can dramatically impact your investment portfolio, both in the short and long term. There are different types of taxes on investments, and each one is taxed differently:

• Capital gains are profits from the sale of an asset. If you own the asset for more than one year and you sell for a gain, then you will pay long-term capital gains tax. The rate depends on your income level and can either be 0%, 10% or 20%. If you own the asset less than a year and sell it for a gain, then the gain will be taxed as ordinary income.

• Dividends usually are taxable income in the year that they are received. Even if you reinvest the dividend income, you pay tax on that income that year. There are two types of dividend income – qualified and non-qualified. Non-qualified dividends are taxed as ordinary income. Qualified dividends are taxed at either 0%, 15% or 20%, based on income level.

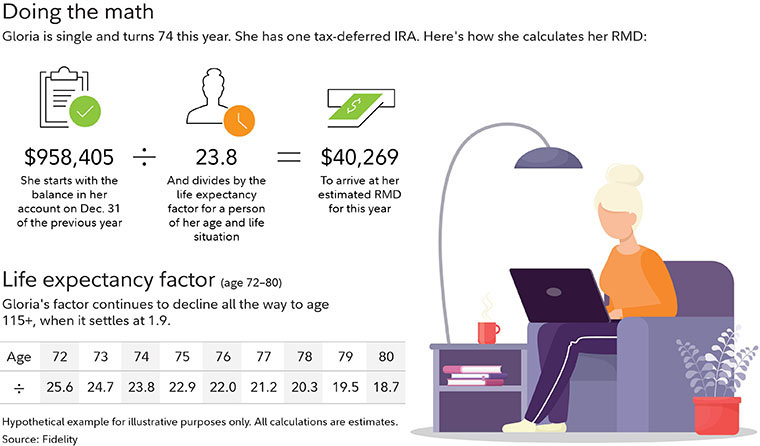

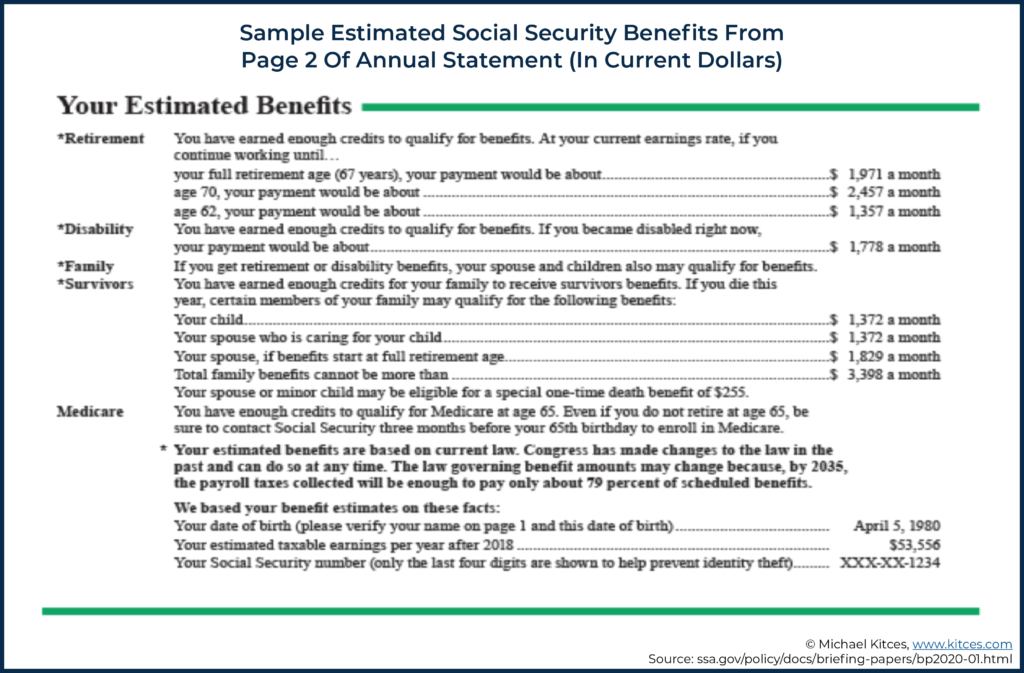

• Investments in 401Ks or IRAs allow you to defer taxes while the money is inside the account. Taxes are paid when you make a withdrawal, and that money is then considered ordinary income and is taxed at your income level.

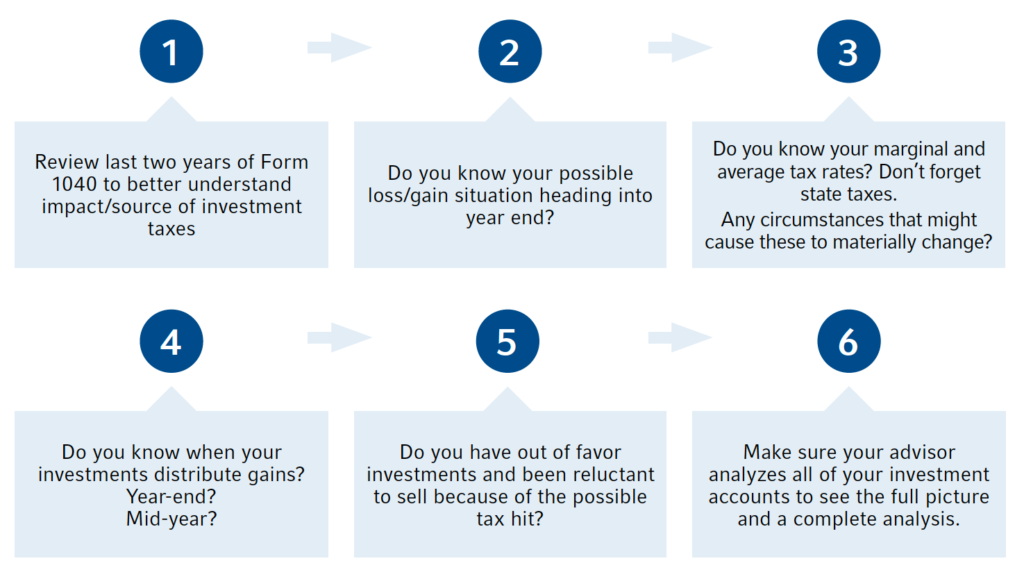

Portfolio design and allocation are very important in order to minimize the tax impact on your returns. Structuring the portfolio to have the least tax-efficient assets in retirement accounts helps ensure that those assets are being taxed at ordinary income levels. The chart below shows the difference that tax management can have in a portfolio over time. If your portfolio is managed inefficiently — if it is heavily traded and focused on short-term gains — a $1 million portfolio could miss out on as much as $500,000 of returns over a 10-year period. Compound interest is an extremely powerful tool — whether it is in a retirement account, such as a 401K or IRA, or a taxable account, earning qualified dividends that are reinvested.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

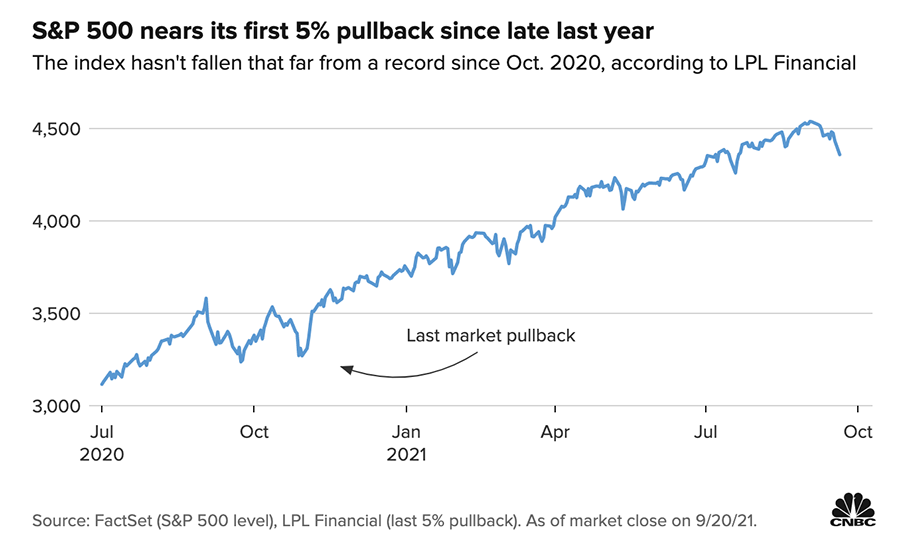

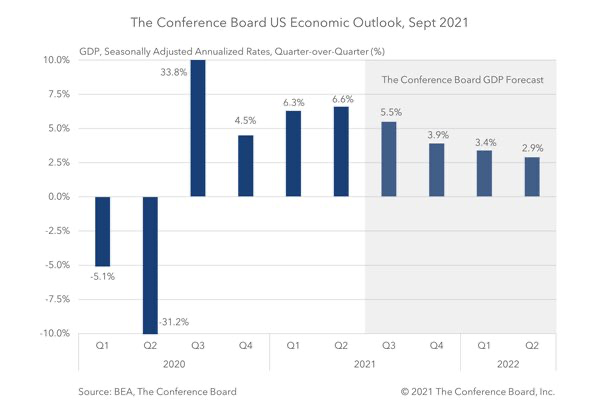

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

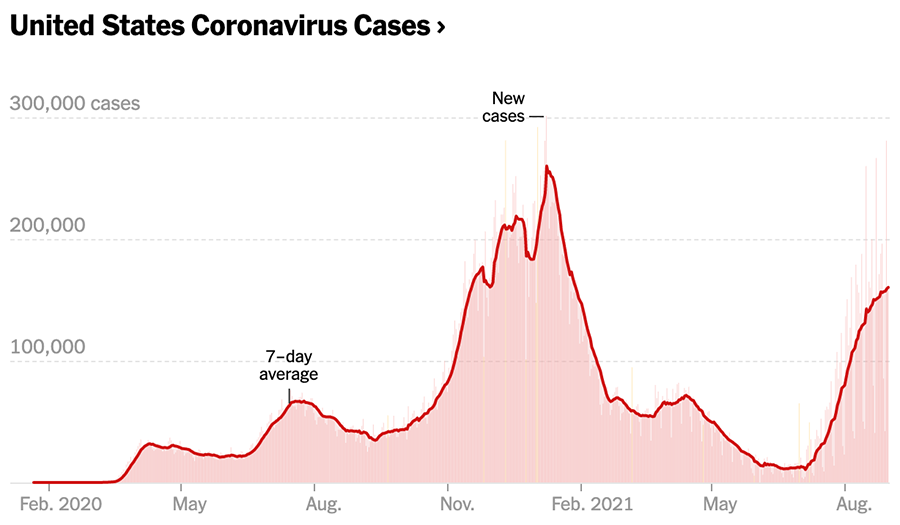

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Fidelity, Forbes, Investopedia, Russell Investments

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.