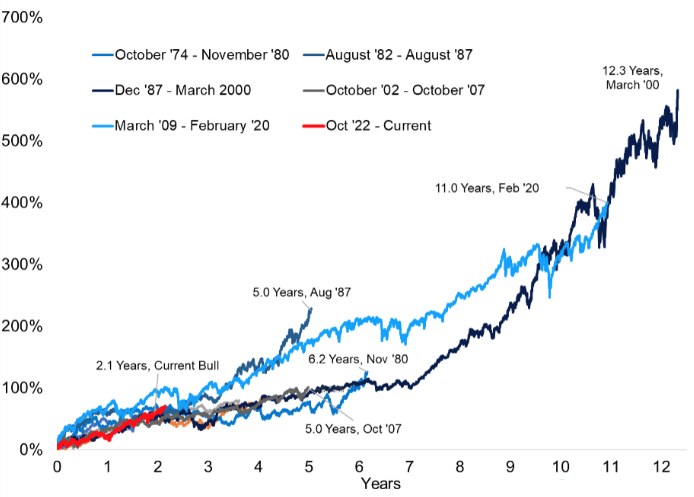

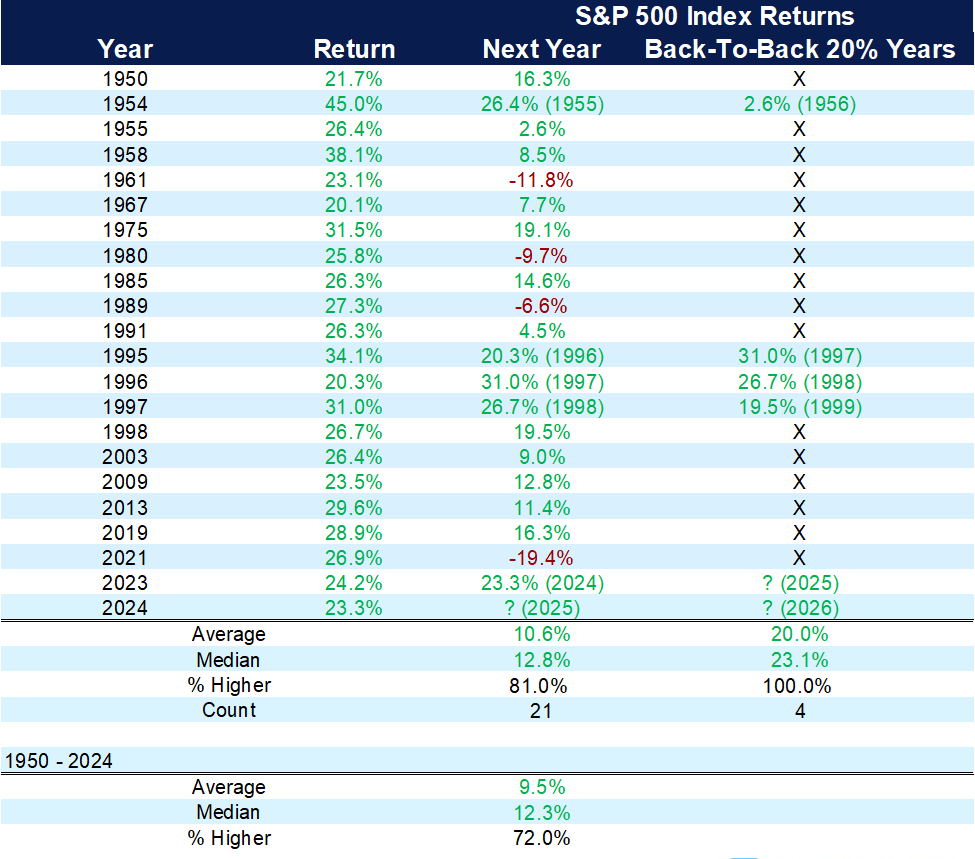

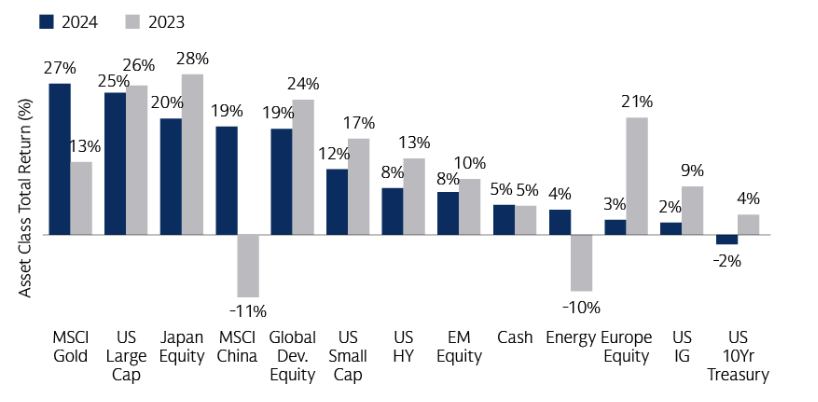

For the second year in a row, the S&P 500 gained more than 20% in 2024, marking the first time that’s occurred since the late 1990s. In each of the last four times there have been back-to-back gains of over 20% since 1950, the market has been higher — potentially a good sign for the year ahead.

Large-growth stocks continued to lead last year, while small-cap stocks and large-value stocks lagged, gaining less than half of large-cap stocks. The Material sector in the S&P 500 was the only sector to finish negative for the year.

Returns After 20% Gains

The Magnificent Seven stocks — Apple, Amazon, Google, Meta, Microsoft, Nvidia and Tesla — returned more than 66% in 2024, boosting gains in the S&P 500 again. Magnificent Seven stocks saw a wider dispersion of returns compared to 2023. Nvidia led the way, up over 170%, and Microsoft brought up the rear, returning only 12% while being the only member to underperform the S&P 500.

The 10 largest stocks in the S&P 500 increased their weight to nearly 40% of the index. Only 19% of the stocks within the S&P 500 outperformed the index itself. The S&P 500 had a maximum drawdown during the year of 8% from its 2024 high, falling short of a 10% correction in 2024. However, both the NASDAQ and Russell 2000 fell more than 10% during the year.

2024 In Review

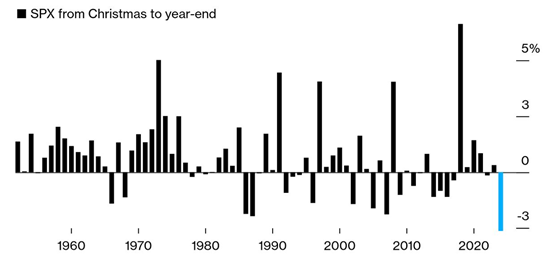

Given the narratives surrounding the election and the upcoming change in administration, the post-election aggressive market gains receded sharply to end the year. The S&P stumbled into the end of the year, with the last all-time close for the year occurring on Dec. 6.

Investors were hoping for a Santa Claus Rally; since 1950, the S&P 500 has averaged a 1.3% gain during the last five trading days of the year and the first two of the new year. Unfortunately, Santa Claus did not come for the market this year; the S&P ended 2024 on a five-day losing streak, down 1.5%. Despite those results, the market had another great year!

The S&P 500’s Worst Year-End Fall Since 1952

Each year, there are defining themes that dominate the markets. In 2020 it was the global pandemic, which caused the supply chain issues of 2021. In 2022, it was all about inflation. Artificial intelligence and the Magnificent Seven led the way the last two years.

Some of these themes can be positive, while others are negative. One thing that is consistent is that one theme always gives way to another — a good reminder to not chase the annual theme and stick with the investment plan. We cannot predict what theme will dominate the markets in 2025.

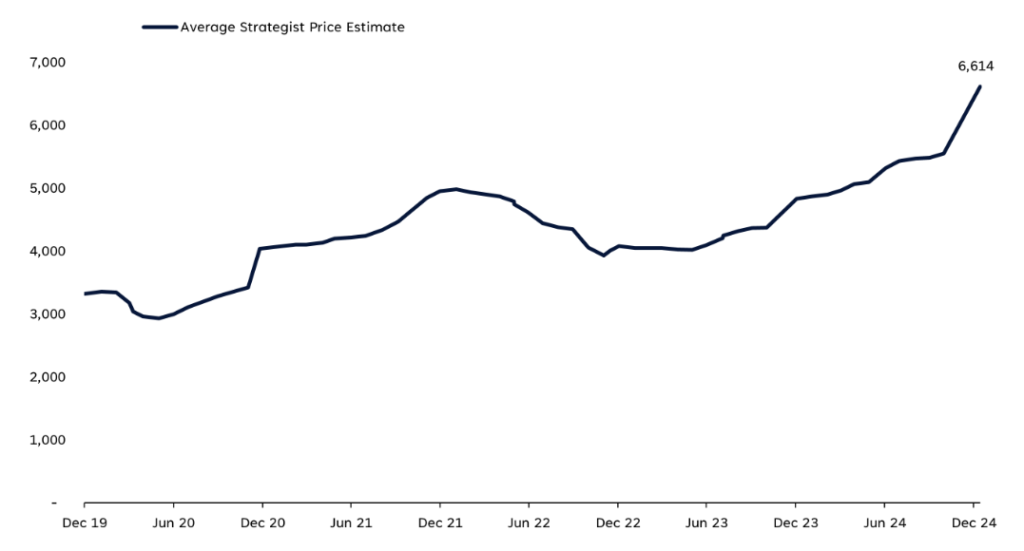

A survey of 15 Wall Street firms arrived at a predicted median S&P 500 value of 6,600 by the end of 2025, a gain of roughly 9% from recent levels. Estimates range from 6,000 to 7,100 on the S&P. Analysts have underestimated the index each year since 2019, with 2022 being the exception when the market fell more than 18%.

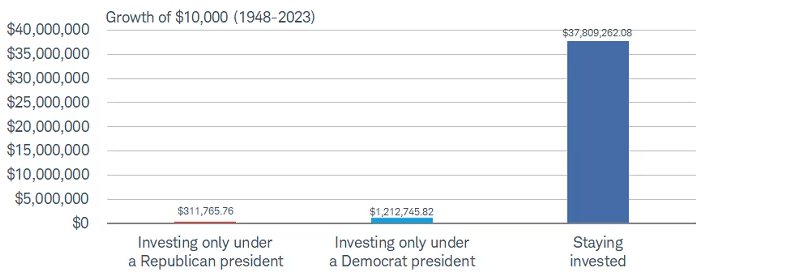

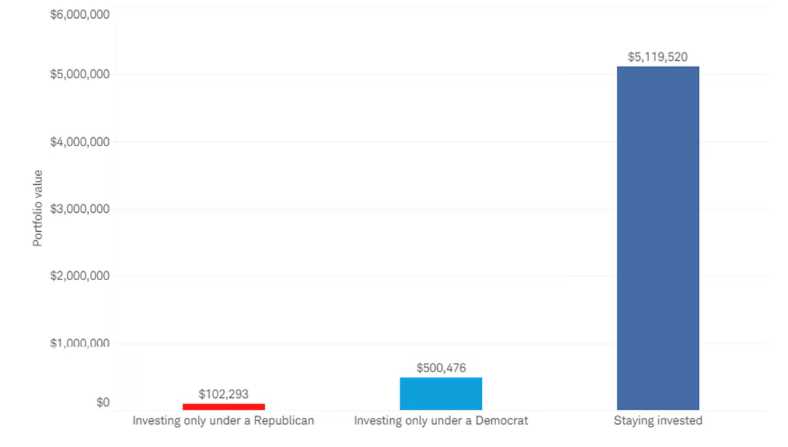

The 2025 aggregate forecast is the most bullish forecast since 2022, as the broad consensus is another positive year for stocks, with the bull market reaching its third anniversary during 2025. At the end of the day, though, these are predictions, and no one knows for sure how this year will play out. What we know is that over time, markets tend to rise — and staying invested is the best strategy.

Average Strategist Price Estimate

We do see many reasons to be bullish in 2025:

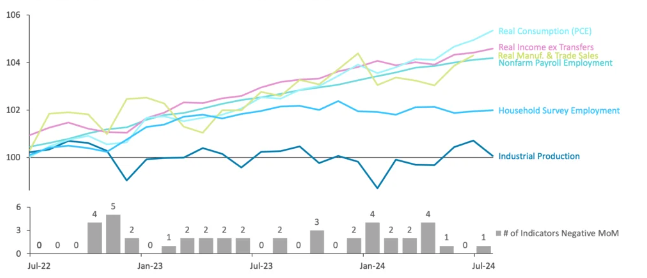

1. The economic foundation remains in good shape headed into the new year.

2. Continued advancement in artificial intelligence leads to innovation among all sectors and industries. Companies continue to spend billions of dollars on infrastructure and AI buildout for the future.

3. Earnings for companies in the S&P 500 are expected to grow by double digits again for 2025, following very strong earnings growth in 2024.

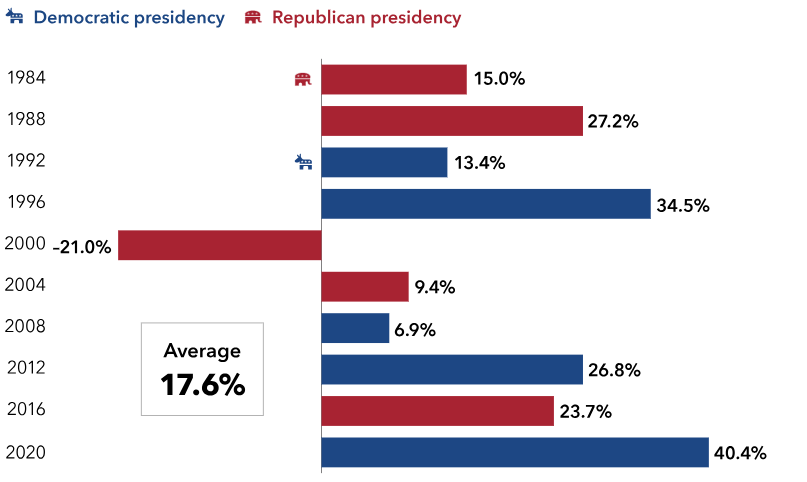

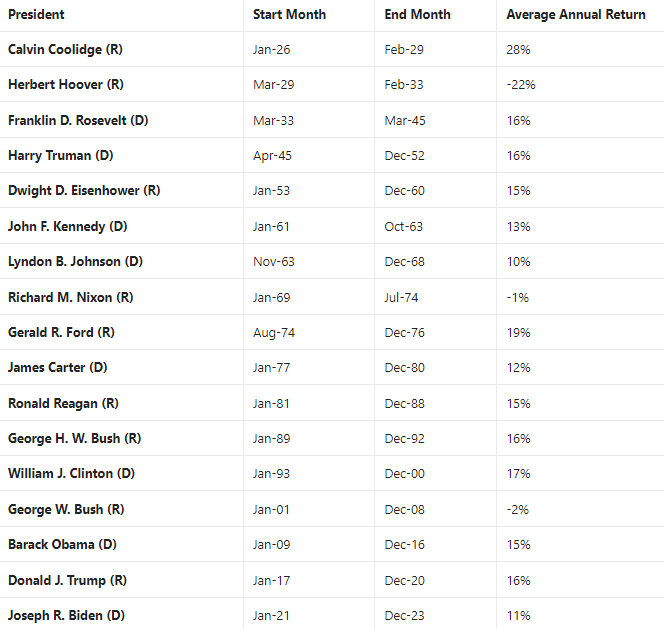

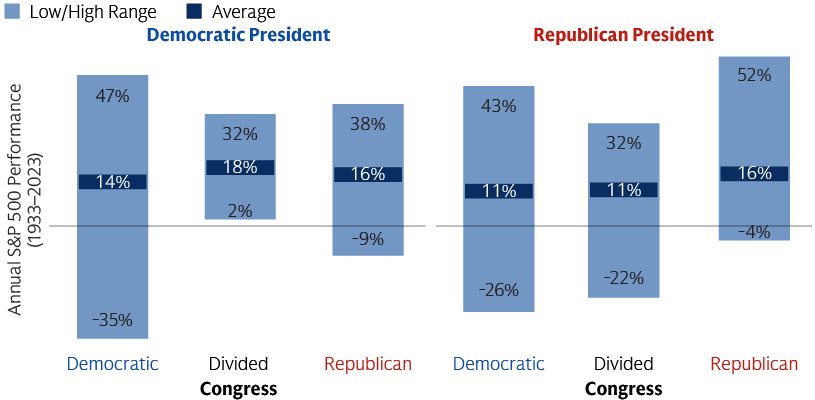

4. Don’t mix politics with investing. Markets have gone up over time, no matter who has been in the White House.

5. Trump 2.0 is expected to reduce regulation and cut taxes. Markets are expecting deregulation that in turn will help foster more merger and acquisition activity.

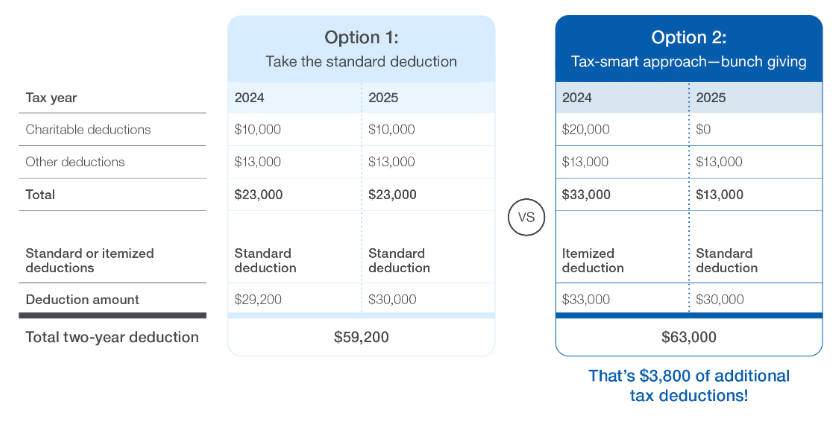

6. Congress is expected to tackle major tax legislation and extend the Tax Cuts and Job Act that was initially passed in 2017.

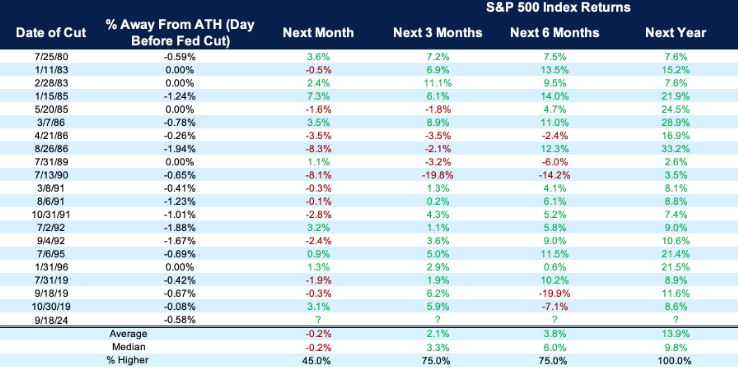

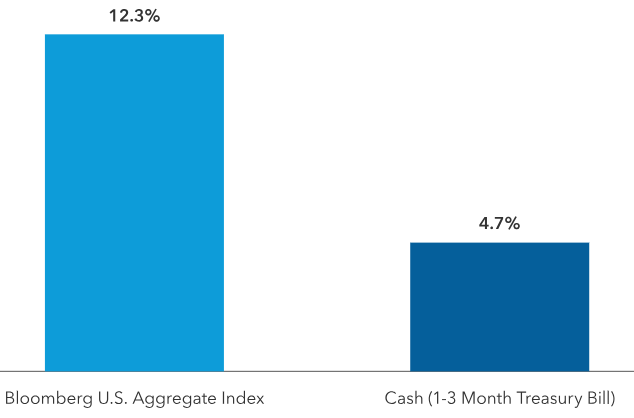

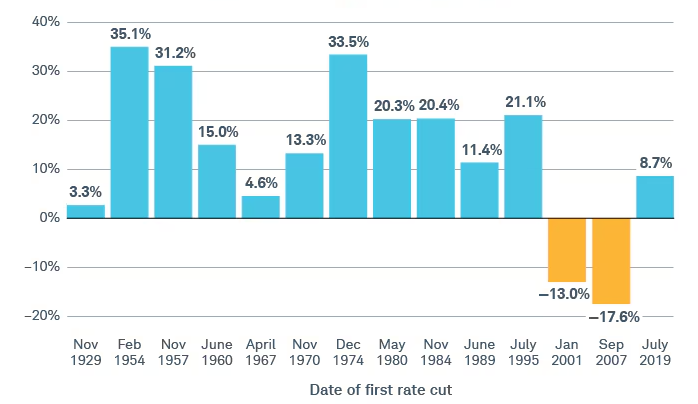

7. The Fed is expected to cut rates twice in 2025 due to higher growth of the economy and is expected to keep the bull market intact headed into its third year.

8. The bull market has advanced more than 67% in the two-plus years since it started in October 2022. History suggests that the bull market has a good chance of celebrating its third anniversary.

9. We expect more balanced growth across the U.S. economy, and we expect the U.S. economy’s continued leadership. Earnings and valuations together suggest the strong potential for a continued broadening of the market.

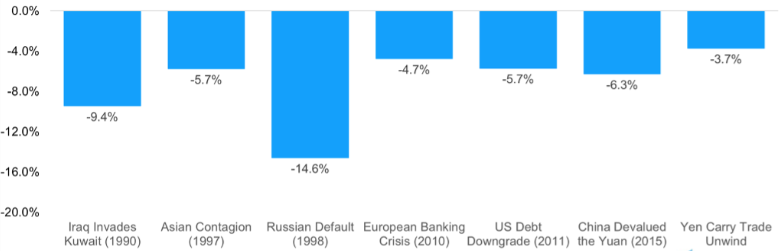

We expect market volatility to be higher in 2025, as there are more unknowns heading into the year, as well as markets that are more fully valued. Higher volatility may cause some worry. Every year there are scary headlines; ignore them.

Market pullbacks are normal, and while markets have gone up over time, they do not climb in a straight line. Since 1980, the S&P 500’s average peak-to-trough correction per year is 14.2%. In 2024, the S&P 500 did not have a correction as an index but came within 1.5% of entering correction mode.

Even strong years have market pullbacks. It is very rare that the market doesn’t have at least a 5% pullback at some point. When the inevitable pullback and correction do occur, we will continue to stay the course and be here as your guide throughout the year.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Schwab, LPL, Bloomberg, Carson, JP Morgan, Capital Group